I said this was a pivotal week and inflection point for the market. And that before the end of the week it was likely I would be positioned one way or the other. Wednesday’s bullish trade and subsequent absolute blowout numbers by Nividia after the close, has sealed the deal for me. I think this market can accelerate higher and there is no need to get the exact bottom. Going long now will be close enough as we look back from what I believe will be much higher levels. If it feels hard to buy right now that is good. If it feels easy to buy right now I could be too aggressive.

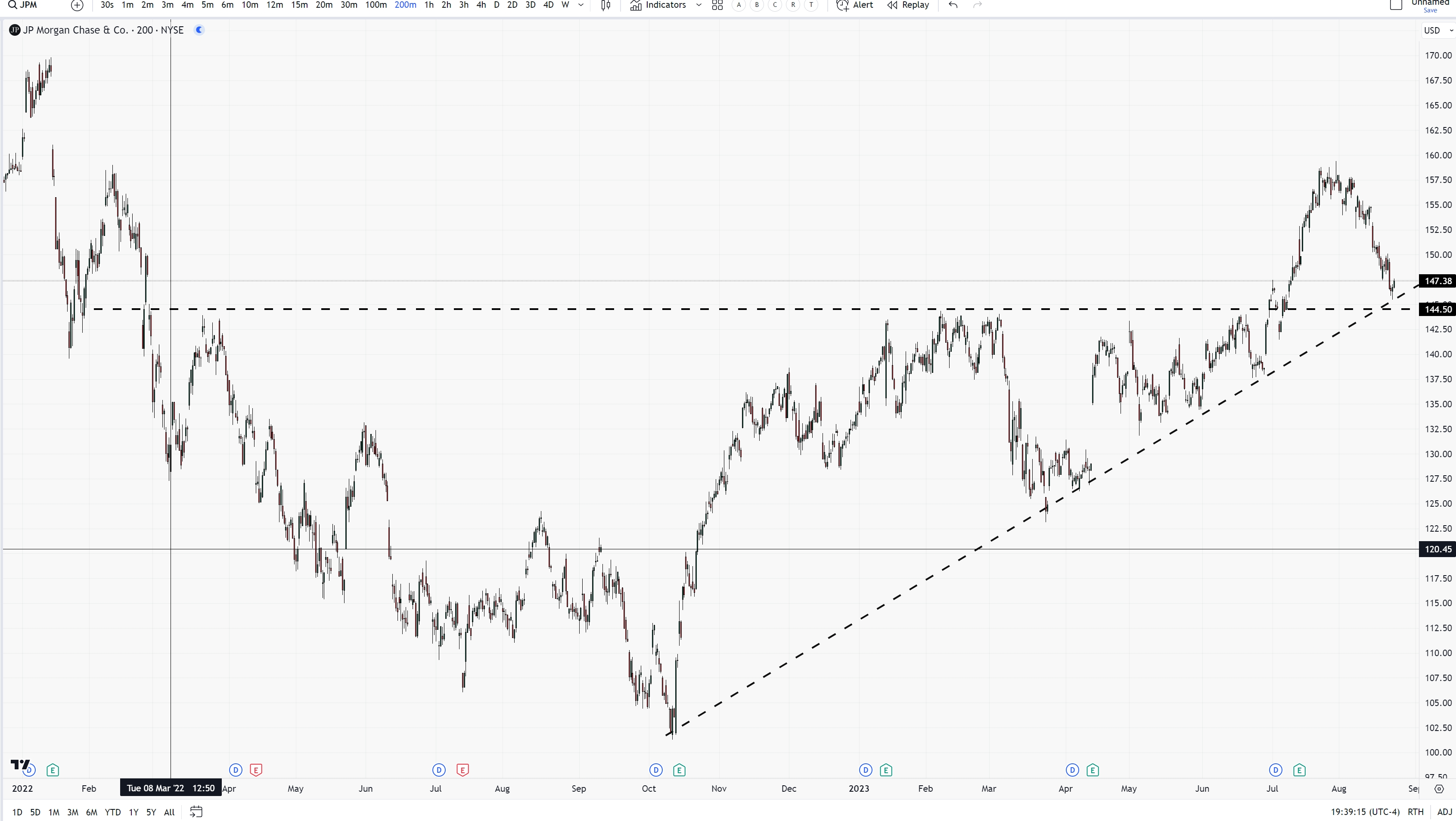

But aggressive is what I think and I will want to buy on Thursday. If we are very lucky, we get a gap higher and then a sell off. No one will expect the sell off, and it will shake out any weak longs and provide opportunity to buy in. Not suggesting that scenario will happen, but if it does be prepared and don’t be afraid to step up. Stocks I will be looking at to buy call options are Draft Kiings (DKNG), UBER, IBM, GOOG, MSFT, and Adv Micro Dev (AMD). One interesting stock here that I was worried about is JPM. It may have been dragged down by regional banks but it has fallen right into support. I kinda like this one, because sentiment on banks is pretty poor right now —and that sentiment may be justified with some of the regionals — but JPM isn’t in that class and the chart is looking attractive.

Overall stay with technology or the stocks above. Main street isn’t the place to be. The last few days we saw more earnings reports from stocks that depend on the retail consumer report disappointing earnings. The rally that I expect is likely going to be centered in the obvious places, so I am staying in those sectors.

Thanks,

Joe

Recent Comments