This year, the market has been more discerning about which Technology stocks it favors. The tape has quietly begun to reward companies tied to precision manufacturing and automation rather than pure-cycle semiconductor names. Leadership has been narrowing, favoring stocks that can grind higher on steady institutional sponsorship instead of headline-driven spikes. That kind of behavior tends to show up first in the moving averages before it ever shows up in the news. Today’s idea fits squarely into that backdrop.

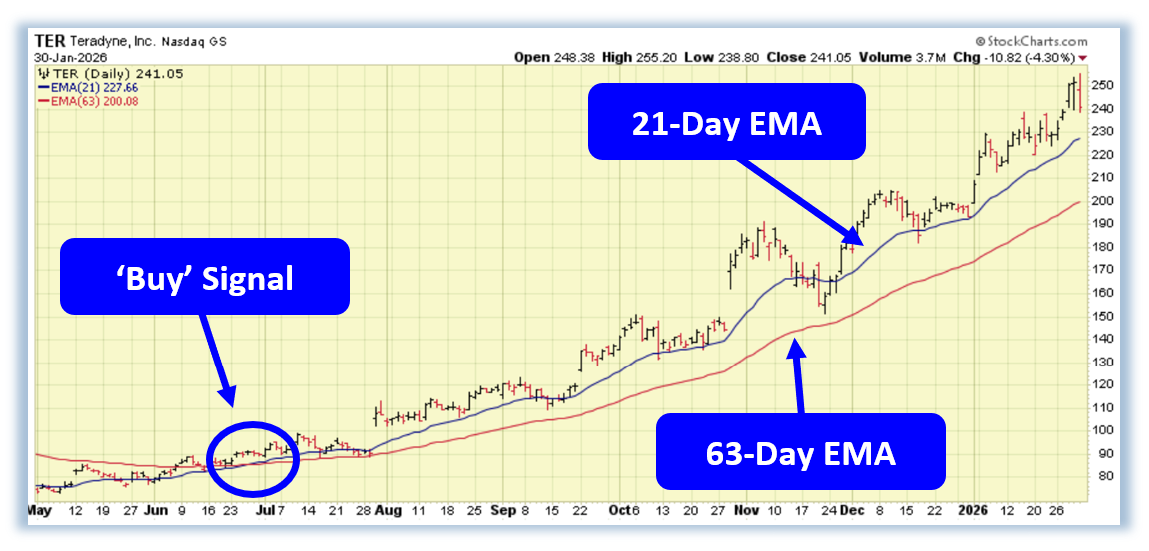

Teradyne (TER) stood out because its 21-day EMA has been holding cleanly above its 63-day EMA since the initial crossover back in June 2025 — a textbook sign that intermediate momentum has been in gear for months, not weeks. Price is now trading above both averages, which in practice means dips have been bought rather than broken. Instead of whipsaw, the chart has been doing what constructive trends are supposed to do: progress higher while keeping risk visually contained.

🧠 Turn complexity into confidence: download our Free ‘Options Trading Made Easy’ E-book and trade with a real, repeatable edge. 📈

Given the stock’s higher share price, a straightforward long call would demand more premium than many traders prefer to allocate. A more thoughtful way to express the view is an in-the-money call debit spread — a defined-risk structure that still allows participation if shares advance, but also has room to work if TER is flat or even drifts lower by roughly 10% into expiration. Structured this way, the hypothetical setup offers about 56.3% profit potential across those scenarios, illustrating how positioning the trade deliberately can tilt the odds in your favor without sacrificing attractive upside.

If you want to see how setups like this are sourced and structured in real time, my Weekly Profit Opportunity Newsletter lays out my top ideas each week. Right now it’s available for a one-month trial at just $1, with hand-picked trade setups sent directly to members. While not every alert is a winner, recent alerts have repeatedly provided opportunities to win on more than 90% of trades — a track record that speaks more to process than luck. Begin your $1 trial today!

Wishing You the Best in Investing Success,

Blane Markham

Chief Trading Strategist

Have any questions? Email us at support@markhamtrading.com

*Trading incurs risk and some people lose money trading.

Recent Comments