When money starts chasing safety and growth at the same time, you know something big is brewing. That’s exactly what’s happening right now in the utilities sector, where one of the country’s most established power providers is breaking out with a surge of momentum that’s impossible to ignore. This isn’t just a quiet drift higher—it’s a high-octane uptrend across every major timeframe, the kind that signals deep-pocketed institutions are making their move. Momentum like this doesn’t happen by accident, and the charts are pointing to the possibility of another powerful leg higher. Traders who overlook a setup like this could be watching from the sidelines while the smart money rides the wave.

That surge of momentum is coming from Dominion Energy (D) — a utilities giant that’s not only keeping America’s lights on, but also reinventing itself for the next era of power demand. Investors are leaning in hard after its latest quarterly update showed stability where it matters and growth where it counts. With energy security and grid reliability dominating the national conversation, Dominion’s position in regulated utilities gives it the kind of durable cash flows institutions crave. Add in its expanding footprint in renewables and infrastructure upgrades primarily to deliver power for A.I. computing in ‘Data Center Alley’ and it’s no wonder traders see this as a rare blend of defense and offense in one stock. The trend isn’t just strong — it’s telling us that big money believes Dominion is built for the long run, and they’re putting their capital behind it!

🔮 Aspiring Investors, are you ready to demystify options trading? Unlock the secrets of the stock and options market with ‘Options Trading Made Easy’ by champion trader Chuck Hughes. Learn the step-by-step plan to navigate risks, potentially increase your capital, and access Chuck’s proven strategies. Get My Free eBook 🆓📖

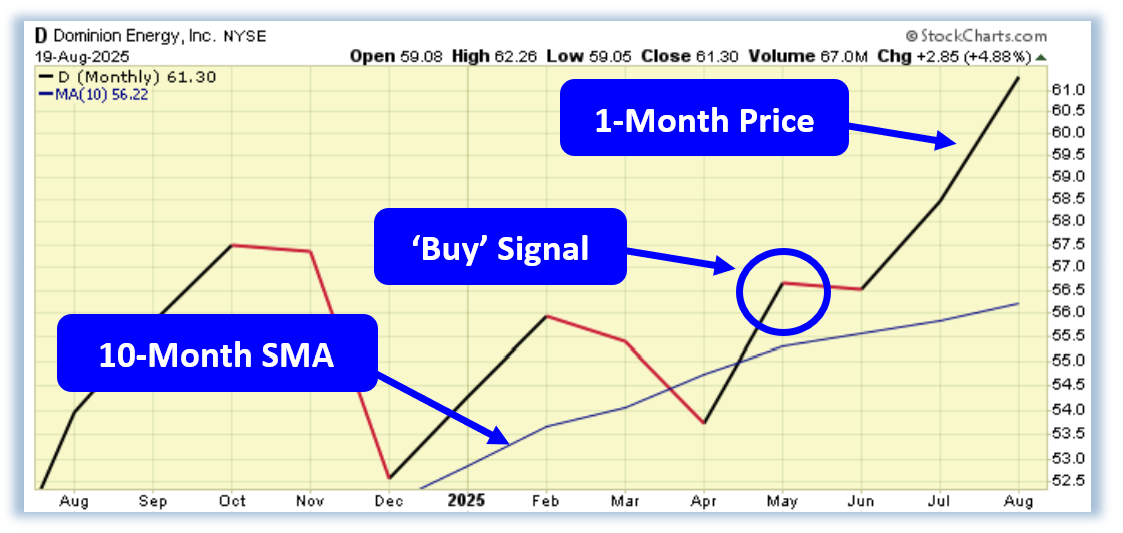

What makes this setup impossible to ignore is the technical confirmation flashing across Dominion’s chart. The stock isn’t just grinding higher — it’s surging with a PowerTrend ‘Buy’ signal, one of the most reliable markers of durable upside momentum. Seeing price push above its long-term moving average with conviction tells us the tide has shifted in favor of the bulls. Breakouts backed by this kind of strength don’t just catch attention—they land squarely on my ‘Buy List’ because history shows they often precede sustained, institution-backed rallies. In other words, this isn’t noise on the chart — it’s a green light that smart money is already moving. And if you’re late to the move, the market won’t wait — miss this entry, and the next leg higher could already be gone.

For my own trading, I’d look to target this breakout with a straightforward call option purchase — the technicals are lined up, momentum is surging, and this chart looks primed for another move higher sooner rather than later. This is exactly the kind of high-probability setup where a call can deliver powerful results in a short window. In fact, at current market prices there is a call option offering 133.6% upside if D shares traded higher by 10% come expiration. And if you want to see more trades like this one, you can’t miss our team’s Weekly Workshop — a video newsletter where we break down several fresh trade setups every single week. Right now, you can check it out for your first month for just $1. That’s not a typo — an entire month of real setups, real analysis, and real opportunity for only $1. Don’t sit on the sidelines while the market moves — click the image below to grab your spot and see what we’re trading this week.

Wishing You the Best in Investing Success,

Blane Markham

Chief Trading Strategist

Author, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

Recent Comments