The market behavior to start 2026 has been wild, to say the least. A handful of stocks have been explosive, others have been disasters, and a number have done very little of interest.

As new investment ideas get allocated to, we are seeing major rotation amidst a generally bullish market, and it’s enough to make even the most seasoned trader’s head spin.

So now, I’m looking at some new ideas based upon what the money flow is telling me and where I can find reasonably defined risk, as always.

For me, that means I look back at the Stock Forecast Toolbox to see what ideas look reasonable without feeling like I’m chasing a wild performer.

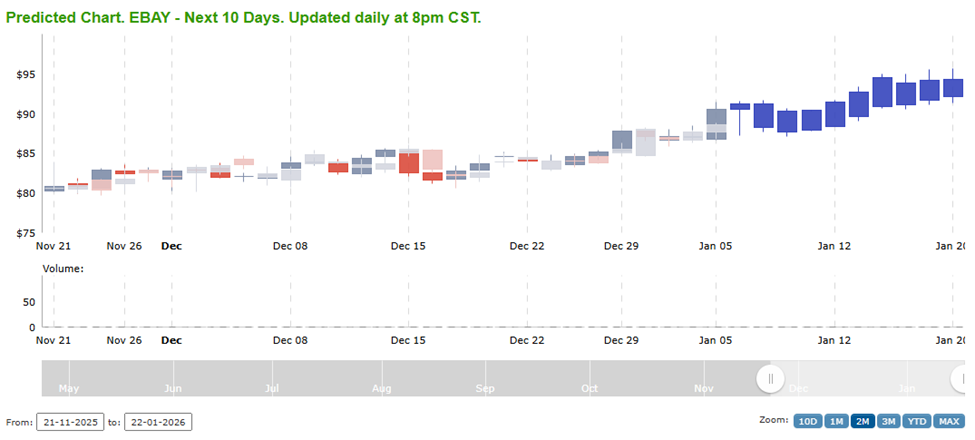

One name caught my eye because of its much more stable bullish behavior, and that’s EBAY:

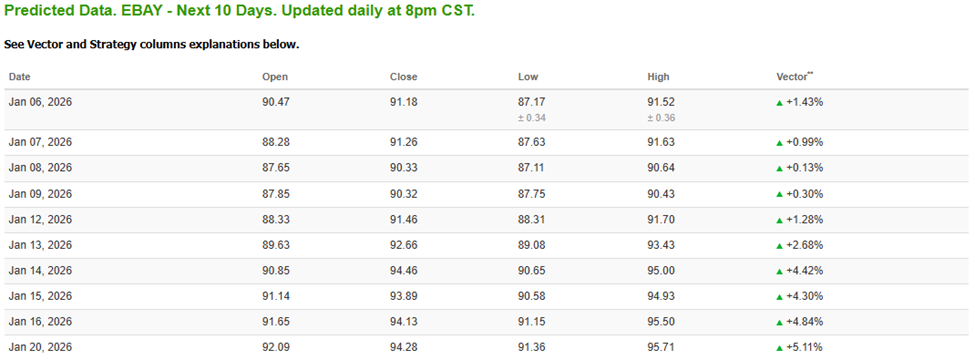

On top of a generally bullish chart, I really like the way the forecast toolbox is projecting its behavior in the near term:

Looking at the AI projected move over the next 2 weeks, the model is projecting a range of $90 to $95, with a generally bullish bias. To give me some leverage for a move like that, I can look at a simple call vertical, buying the January 16th, 2026 $90 call and simultaneously selling the January 16th, 2026 $94 call, which is currently valued at $1.82. If the model is right, I could be looking at a 100%+ return on this trade, and that’s an exciting setup for me!

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments