by Jea Yu

Just like carving up a chicken, there’s primarily four meaty parts to earnings report trading. Using the analogy of the breast, drumsticks, thighs, and wings – the key is to make sure the meat is fully cooked!

Post-Market Reaction: Thigh

First of all, not every earnings report is playable in the post-market. Only the thicker, widely traded stocks should even be considered, because volume and spreads will make a big impact on liquidity. Listed stocks tend to have wider spreads by nature. In addition to the liquidity concerns, the stock must actually have a tradable reaction. There needs to be a tradable reaction.

Keep in mind that the most domestic (U.S. – based) companies have conference calls to discuss the earnings reports, usually around 5:00pm, if the earnings are released post-market. Many times, stocks will actually rise about 15 minutes ahead of the conference. Unless you plan on listening to the actual call, this is another reason to finish your post-market trading before 5:00pm. Let the market digest the information and play it in the pre-market session. Conference calls can be a wild card, as they can sometimes tank gapping stocks and squeeze dumping stocks.

Use the galvanized support and resistance levels like pinball bumpers. On the most anticipated earnings report stocks, CNBC will usually chime in a few minutes after the report to talk it up or down; this adds an extra volume thrust to which you should pay attention.

The post-market reaction is not usually recommended to trade for most people, as you have to be acclimated to the movement of the underlying stock.

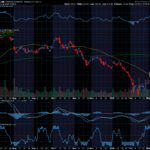

Pre-Market Gappers and Dumpers: Drumsticks

The 5- and 1-minute full data charts are used with the galvanized support and resistance levels. Look for pups and mini pups off the 5-minute charts with 1-minute triggers. Always be aware of the direction of the noodles, as they represent the market winds. Any sharp noodles movement will likely have an effect on the stock. Make sure to align the moves with the noodles, unless there is a presence of a very strong fade. If there is a fade, then time entries right when noodles exhaust for a more forceful move.

For example, let’s say ABC stock gaps down and forms a 5-minute inverse pup pre-market. The noodles take a sharp bounce up, but ABC is sell fading the 5-minute 5-period moving average. The noodles peak at a pivot resistance as the 1-minute stochastics slip back under the 80 bands. The 1-minute stochastics form a mini inverse pup on ABC. This is the perfect trigger to step in short, as the noodles selling will magnify the effect on ABC stock since it couldn’t bounce with the noodles.

Market Open: Breast

In most cases, you will want to lock out positions ahead of the opening bell. Even the thickest stocks can shake violently on the market open after an earnings report. The only exception is if the 5-minute chart is showing a solid mini pup-fueled trend into the open with a 1-minute mini pup. Look for a continuation move off the 9:30am opening bell, but trim down shares to a minimum.

The first 10 minutes of the open will be the most violent. Eventually, the 3-minute 5-period moving average will catch up to the stock price and either form a pup, mini pup, or a tightening. The safer trade is to wait for this to happen first. The key is to wait for this to resolve by having the market thoroughly test the 13-minute 5-period moving average with at least 2 candle closes above or below before stepping in on a mini pup for trend continuation, or mini inverse pup for tightening.

Dead Zone: Marinating Process

By 11:00am, gappers and dumpers tend to cool off on the volume and chop around for several hours. Don’t bother playing this chop period. Consider it a marinating process that will hopefully produce something consumable for the last hour.

Last Hour Considerations: Wings

Stocks that have dramatic gaps up or down tend to take all day for the 60-minute 5-period moving averages to finally test. This is the marinating process. The last hour is usually when the final moves come into play.

If the 60-minute 5-period moving average holds support on an uptrend and coils with a mini pup, then look for a play in the last hour. Make sure that the shorter time frames support the direction of the 60-minute, and use the 1-minute triggers.

If the 60-minute 5-period moving average breaks with the 3:00pm candle close, then revert to using the 60-minute 5-period moving average re-break as a trail stop. Make sure that the shorter time frames support the direction of the 60-minute, and use the 1-minute triggers.

The inverted version of this play sets up on dumpers where the 60-minute 5-period moving average held resistance going into the last hour with a mini inverse pup. Make sure that the 8- and 13-minute stochastics are crossed back down, and then take the 1-minute trigger. Often, the stock may sell fade, but the actual panic down won’t get follow-through until the 8- and 13-minute stochastics cross down.

Recent Comments