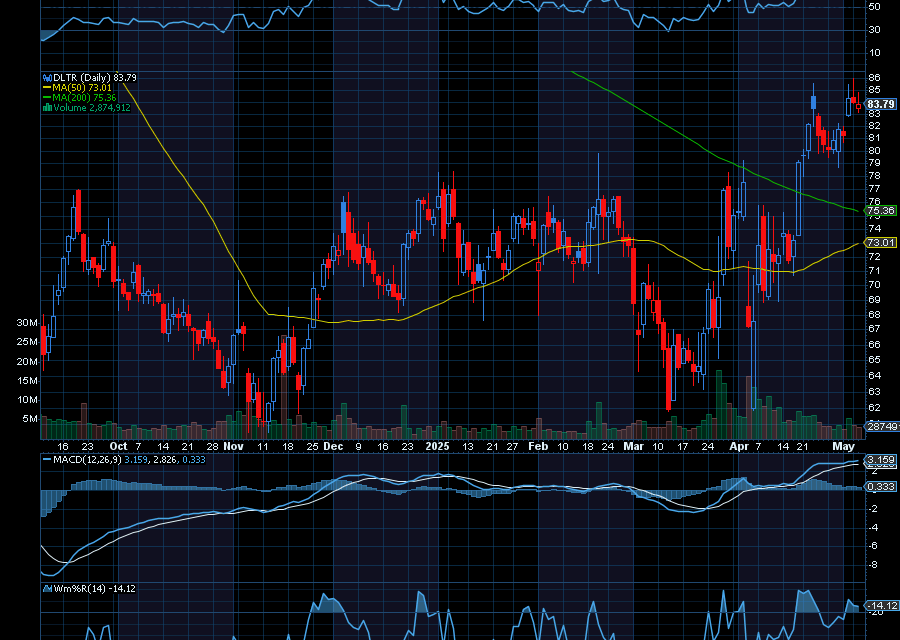

Dollar Tree is one of the best performing stocks in President Trump’s first 100 days back in office. Since inauguration, DLTR is up about 36%. It’s also outperforming the consumer staples sector. “Historically, the dollar stores have done better in softer macro environments, especially if we were heading into a recession,” said CFRA Research, as quoted by CNBC.

Helping, CFO Stewart Glendinning just paid $1.24 million for 17,000 shares of DLTR in mid-April. He paid an average of $72.75 per share.

Plus, according to analysts at Citi, DLTR is “a dark horse winner in the new tariff world.”

“While Dollar Tree was previously trying to manage China tariffs within its current pricing architecture, this higher tariff regime gives them further cover to expand price points from $1.25 to $1.50 – $1.75,” they added.

Sincerely,

Ian Cooper

PS–I am going to be joining John Boyer for a live Eye Opener market session next Thursday, May 15th at 9am ET. I am going to walk through a hot chart and breakdown what makes it look like a winner. He just started inviting people to be in the session and as questions but the online room is very small. Sign up now and lock in your spot. Click Here.

Recent Comments