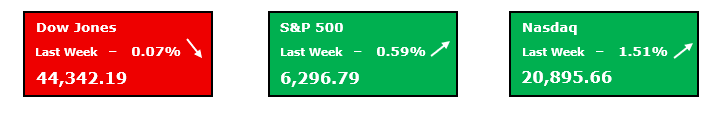

Headed into last week, it was clear that the powerful trend underlying the market was still strong and intact but, as communicated in prior weeks, stocks were a little overheated and due for a slight pullback. This is exactly what played out through the middle of last week, we got a slight retracement, almost down to the middle Keltner band. This was exactly what stocks needed, allowing for the necessary cool-down & consolidation and by the end of the week stocks reaccelerated and several more new all-time highs were made on both the S&P 500 & the Nasdaq! The late-week moves higher were largely powered by several factors—both CPI & PPI inflation reports came in either in line or cooler than expected, initial jobless claims continued to decline, and retail sales for June came in ahead of the consensus forecasts. Each of these reports delivered results that were about as good as investors could have asked for given the setup. As each of these bullish catalysts continued to pile up, this provided investors with confidence leading to strong buying pressure support for stocks. As the positive events of last week propelled stocks to new all-time highs yet again, this is a solid setup headed into the week. Stocks are not currently overbought according to the charts and momentum is starting to build once again. This coming week will have plenty of catalysts to determine stocks’ next moves, but we anticipate that stocks will continue to break out higher and build on this current trend.

Before diving into this week’s market catalysts, I want to take an overview of stocks according to the charts and see what the technicals are telling us. As noted above, we closed the week, setting several new all-time highs, continuing a recent pattern of higher highs and higher lows. This of course is a strong bullish undercurrent, but I want to dive further into the charts. Under the hood, we can see that participation to the upside is continuing to broaden out with the equal-weighted S&P 500 again trading higher. This is also confirmed by the percentage of S&P 500 stocks trading above their 50-day MA & 200-day MA now at 68.0% & 60.1% respectively. As these percentages continue to build, this will offer even more durable support for the market’s current trend. Additionally, the Advance/Decline line for the S&P 500 index is now sloping higher once again and on the verge of breaking to new highs. This is yet another sign of broad-based strength in this market and exactly what one would want to see if you were hoping for a durable, long-lasting bullish run. One further point I’d like to make is this—Bitcoin has leaped higher in the past few weeks, exploding to new highs. Given the price of this cryptocurrency is driven largely by supply/demand dynamics and investor enthusiasm, as risk appetite builds, $BTC generally displays positive price action. There is a correlation that has held up pretty consistently in recent years, where $BTC serves as a reliable leading indicator for price action on the S&P 500. Meaning that oftentimes $BTC will leap to new highs and shortly thereafter it is followed by a nice rally in equities. I think we are seeing yet another example of this playing out right now, so keep an eye on this. The setup for this week is still solidly bullish as stocks try for their fourth positive week in five.

⚡ Special Promo: First Month Access for Only 1$⚡

Have you joined my Weekly Profit Opportunity newsletter yet? If not, then you just missed out on a recent trade alert I sent to members that has risen 117.4% in just a few weeks! While past results do not guarantee future returns, this newsletter features my top trade pick each week!

Key Events to Watch For

- Tariff Updates

- Q2 Earnings Continue (GOOGL, TSLA, IBM)

- Fed Chair Powell Speech

Despite the tariff uncertainty overhang on stocks, the market has clearly displayed that it is still in ‘wait and see’ mode regarding how stocks will trade due to tariffs. This week, I expect investors to continue keeping an ear close to the ground regarding any updates on U.S. trade policy and tariffs. Even as investors have broadly shown impressive resiliency in recent weeks, blocking out the tariff-related noise that has been rampant in financial reporting, the new Aug. 1St deadline is approaching fast. Aug 1st is of course the new date when increased tariffs are set to kick in on various trading partners. Again, seemingly the market is calling the bluff on this date since there have been so many delays to date. At this point I don’t expect stocks to overreact to tariffs unless a much higher than expected tariff level is imposed and actually enforced on a significant trading partner. The market is still very much in the camp that existing tariff levels that have been put forward will be negotiated much lower. Still, as the Aug 1st date approaches, it’s worth investor’s at least being mindful of the event.

After Q2 earnings ramped up last week, the earnings bonanza continues this week as a significant portion of the S&P 500 is set to report. While there are numerous companies on the schedule to report, the handful that stood out to me as the most significant to the market are GOOGL, TSLA, & IBM. While each day this week will feature a number of major reports, oddly enough, all three of these companies are due to report on Wednesday once the market closes. The market consensus is that both GOOGL & IBM will report YoY Q2 EPS growth of 15.3% & 9.1%, respectively. On the other hand, analysts are expecting TSLA to report a YoY decline of 23.1% in their Q2 EPS. Each of these companies are major spenders in the A.I. race too. Any commentary regarding A.I.-related spending or developments in this field will likely be heavily scrutinized from each of these three companies.

After last week’s jam-packed schedule of economic data, this week is quite the opposite. It is set to be a pretty quiet week regarding fresh economic data that could move markets. However, there is one event that is likely to get a good bit of attention from the market. Despite the FOMC members being in their pre-meeting quiet period, on Tuesday, Fed Chair Powell is set to deliver a speech at a banking conference. This event is notable for several reasons. Firstly, there is an FOMC meeting next week and investors will be searching for clues about next week’s rate decision. Secondly, in recent months, the Administration has been ramping up sharp criticism of the Fed Chair and some are concerned that there may be an attempt to fire the Fed Chair, casting doubt on the Federal Reserve’s independence. On several occasions recently the market has reacted to threats against the Fed’s independence and the message was clear that it should not be threatened. It would be reasonable to expect that further attacks on Chair Powell will accelerate into and after this upcoming meeting particularly should the committee opt not to cut rates as this is the source of the gripe. Currently, the CME Group’s FedWatch tool gives a 95.3% probability that the Fed leaves rates at current levels following next week’s meeting. So, this could be the source of some headline fireworks that could move markets.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments