On July 8, we said:

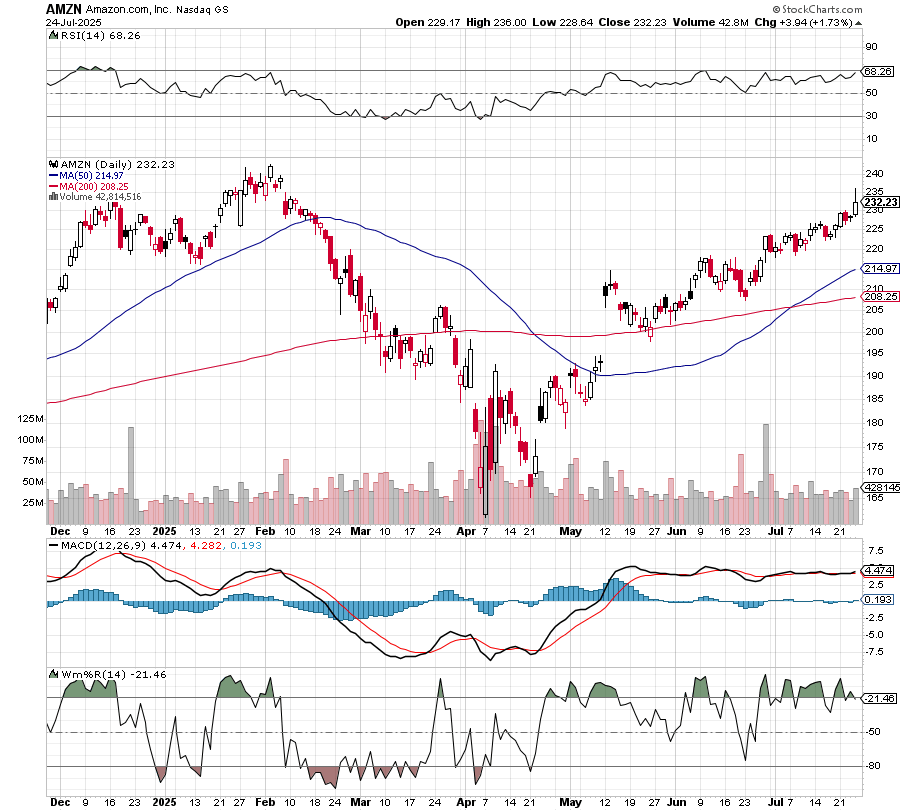

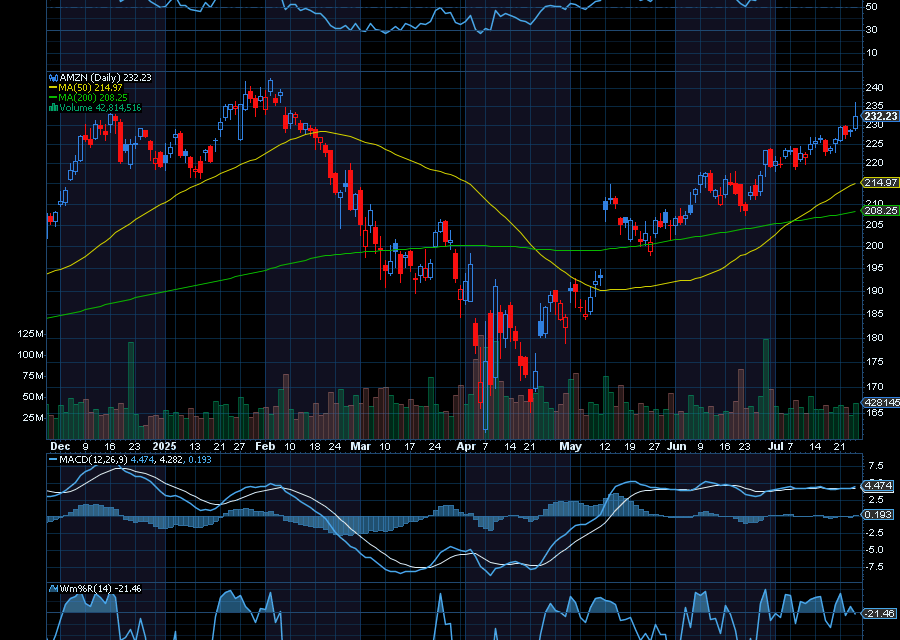

Since 2016, every time there’s been a golden cross (50-day moving average jumps above the 200-day moving average), the stock has turned even higher.

Around the start of April 2016, a golden cross appeared before the stock ran from about $30 to about $100. It happened again at the start of 2020 before the stock ran from about $85 to $178. It would happen in late May 2023 before AMZN ran from about $115 to $239. And it’s just starting to appear again now at $221.55.

Not only did the golden cross appear, as hoped, AMZN is now up to $232.16 and could soon challenge $242.52 resistance.

Fueling momentum, the company just secured its spot with artificial intelligence. All after Amazon agreed to acquire Bee – which makes a $50 wristband — equipped with AI and microphones that can listen to and analyze conversations to provide summaries, to-do lists and reminders for everyday tasks.

Plus, Bank of America just raised its price target on AMZN to $265 from $248. “The bank cited expectations of a second-quarter retail beat and potential acceleration in Amazon Web Services (AWS) growth in the second half of the year,” as noted by Investing.com.

With a good deal of momentum, we’d like to see AMZN closer to $242.52 near term.

Sincerely,

Ian Cooper

Recent Comments