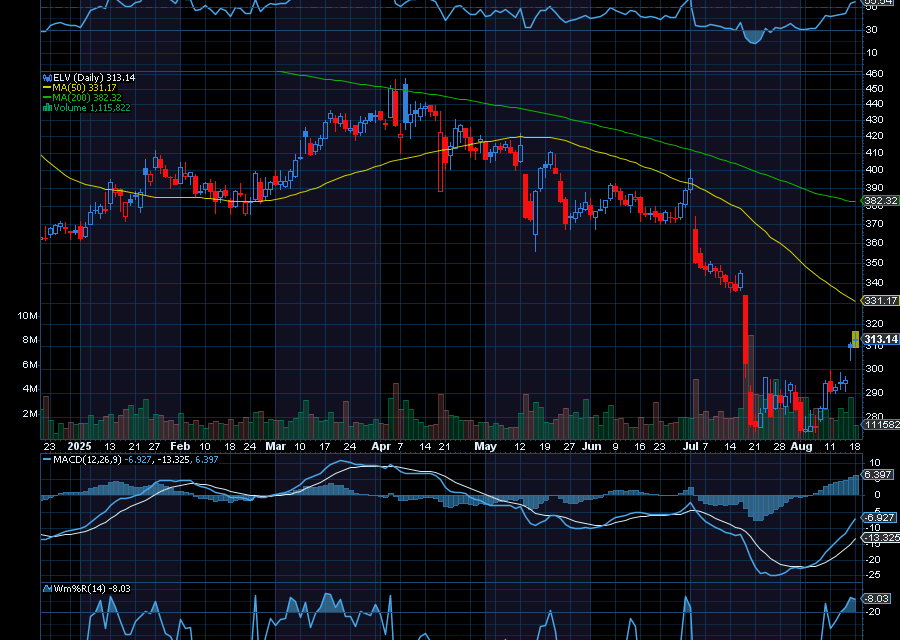

In late July, we noted, “Keep an eye on Elevance Health (ELV). Over the last few days, the stock gapped from about $340 to a low of about $274.40. That was after the health insurer cut its guidance. However, it appears most of that negativity has been priced into the massive pullback. Plus, on the day of the pullback, CEO Boudreaux paid $2.4 million for 8,500 shares at an average price of $268.94 per share.”

At the time, ELV traded at $289.10. Today, it’s up to $309.57.

From here, we’d like to see ELV initially retest $340. Longer term, we’d like to see the stock refill its bearish gap at around $400. Helping, most of the fear is now priced in. Plus, it appears to be piggybacking sector bullishness, especially with Warren Buffett’s Berkshire Hathaway buying five million shares of UnitedHealth Group for about $2.1 billion.

Sincerely,

Ian Cooper

Recent Comments