When markets get volatile, keep your portfolio safe with dividend ETFs.

For one, these ETFs and their holdings can help smooth out the volatile ride when markets drop. Two, they offer exposure to a diversified portfolio of respected companies that have a history of paying dividends, which can provide a steady stream of income.

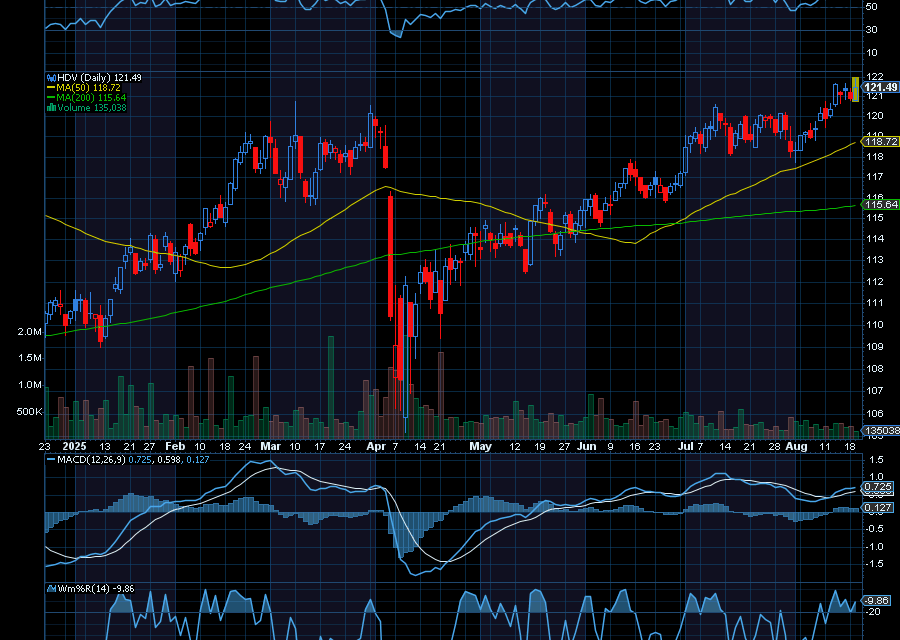

Look at the iShares Core High Dividend ETF (HDV), for example.

With an expense ratio of 0.08% and a yield of 3.41%, the HDV ETF tracks the investment results of an index composed of relatively high dividend-paying U.S. equities.

Some of its 75 holdings include Exxon Mobil, Johnson & Johnson (NYSE: JNJ), Progressive Corp. (NYSE: PGR), Chevron (NYSE: CVX), AbbVie (NYSE: ABBV), Philip Morris, AT&T and Coca-Cola (NYSE: KO), to name just a few.Since bottoming out at around $105.19 in April, the HDV ETF rallied to a recent high of $121.67. Now at $120.85, we’d like to see the ETF rally to $140 next. While we wait, we can collect its yield. The ETF last paid a dividend of just over 93 cents on June 20. Before that, it paid a dividend of just over 79 cents on May 21.

Sincerely,

Ian Cooper

Recent Comments