The market is evaluating an inflection point and trying to determine whether new highs are justified.

It continues to be a stock-picker’s market as we see frequent rotation between stocks and sectors, giving a lot more noise than signals in this environment.

And that’s why I focus on the Forecast Toolbox in an environment like this.

Rather than trying to filter through hundreds of charts, I can get a short-list of higher probability setups that incorporate large amounts of data to find the best trade ideas out there.

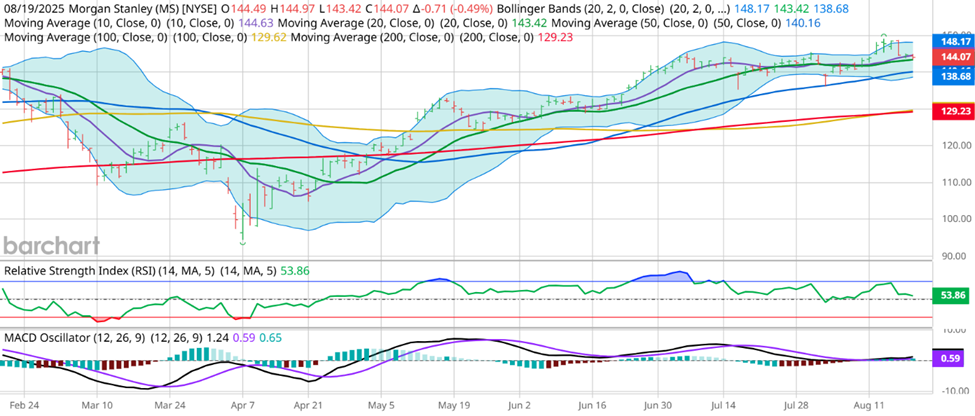

As a prime example of this, I highlighted the potential of MS as a stock that didn’t need to go up, but was forecasted to stay above $142:

In this case, the $142/$140put credit spread expiring on August 22nd could have been sold for about $0.53 last Tuesday morning. While the stock rallied aggressively by the end of the day Tuesday, it turned out to be more noise than signal, and now the stock is down just over $1 since the open on Tuesday. However, the put credit spread is now down to $0.35. This is the key power of utilizing the right options structure for the trade setup.

But now, I’m looking for a bullish stock despite Tuesday’s weak market action. Why? Because the Forecast Toolbox highlighted it and it continues to look good despite the recent market headwind.

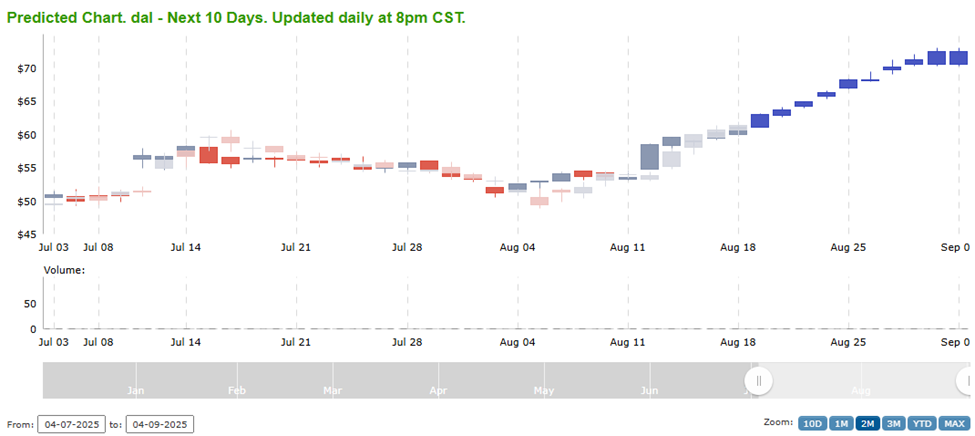

Delta Airlines is that stock (DAL):

After strong earnings for DAL, the entire airlines sector has been rallying for the past week or so. And the Forecast Toolbox likes it:

With projected upside to $72 in the next 2 weeks, this is an exciting setup. The September 19th $62 calls are currently $2.40 and could turn into a huge win if even half of the projected move comes to fruition.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

If you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments