Gold just hit a new record high above $3,500.

Last trading at $3,525.86, the metal could test $4,000 – with investors hunting for safe havens with economic uncertainties.

For one, gold is pushing higher after a U.S. appeals court ruled that President Trump’s global tariffs are illegal. However, the court is allowing current tariffs to remain in place through October 14, with the court giving Trump time to file an appeal with the U.S. Supreme Court.

Two, gold is rallying on a potential interest rate cut at the Federal Reserve’s September meeting. We also have to consider that gold ETF inflows soared to 170 tonnes in the second quarter of 2025. That, combined with first-quarter inflows, resulted in the strongest first half for gold inflow since the pandemic-fueled inflows of 2020.

Fueling more upside are geopolitical and economic uncertainties, growing central bank demand, and a weaker U.S. dollar. Plus, analysts at Fidelity say the safe-haven metal could soar to $4,000 by the end of next year. Goldman Sachs and Bank of America are also calling for $4,000 gold by 2026.

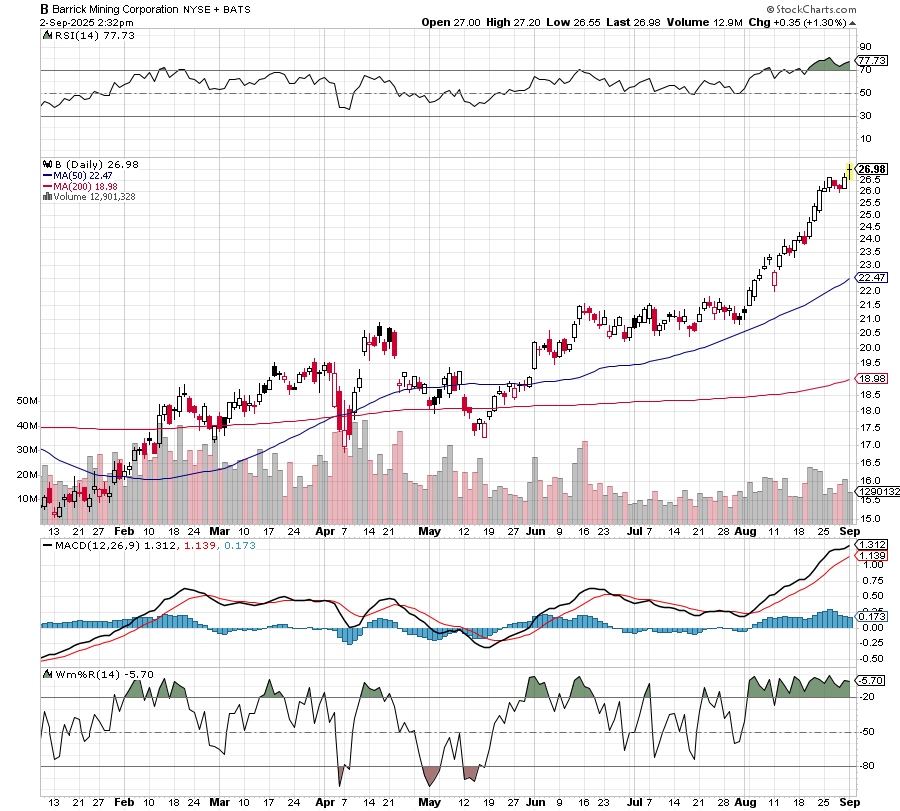

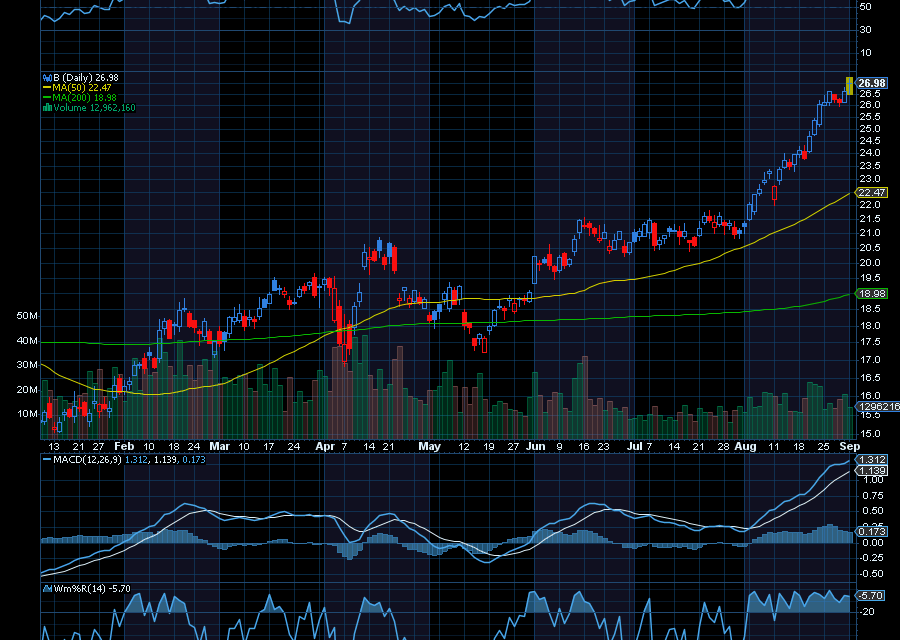

One way to trade further upside in gold is with a mining stock, like Barrick Mining (B) – which was just upgraded to an outperform rating by analysts at CIBC. With a price target of $30, the firm is encouraged by Barrick’s quarterly results and stronger outlook. Barrick also raised its dividend to 15 cents, which is payable on September 15 to shareholders of record as of August 29.

Recent Comments