The market continues to chop. The S&P 500 makes new highs, only to dip quickly on a fundamental input, then grind back to a new high. This process has been repeated on a weekly basis and can cause major frustration for those looking for a major directional move.

With PPI and CPI data due out this week and an FOMC decision next week, it’s easy to see why the market may be in a bit of a holding period and have a lot of signals without a lot of follow-through.

And that’s why I continue to focus on the Forecast Toolbox in an environment like this.

Rather than trying to filter through hundreds of charts, I can get a short-list of higher probability setups that incorporate large amounts of data to find the best trade ideas out there.

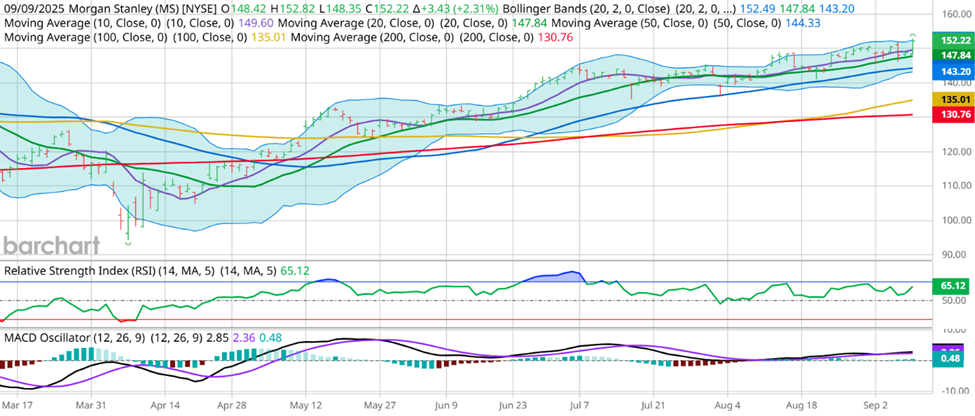

Before getting into this week’s idea, I want to touch on last week’s idea, in Morgan Stanley (MS):

In this case, the $145/$143put credit spread expiring on September 19th could have been sold for $0.65-$0.75 last Tuesday morning. The stock has been chopping back toward highs and now attempting to breakout as of Tuesday’s close, and the put spread is down to $0.17. This is the key power of utilizing the right options structure for the trade setup and using all of the tools at my disposal.

And now, rather than looking at a stock that should be less likely to go down aggressively like MS last week, I’m looking at a potential bullish diamond in the rough given the setups that I’m seeing. Utilizing the Forecast Toolbox highlighted this lesser-watched, but well known company for me given the potential upside in the near term.

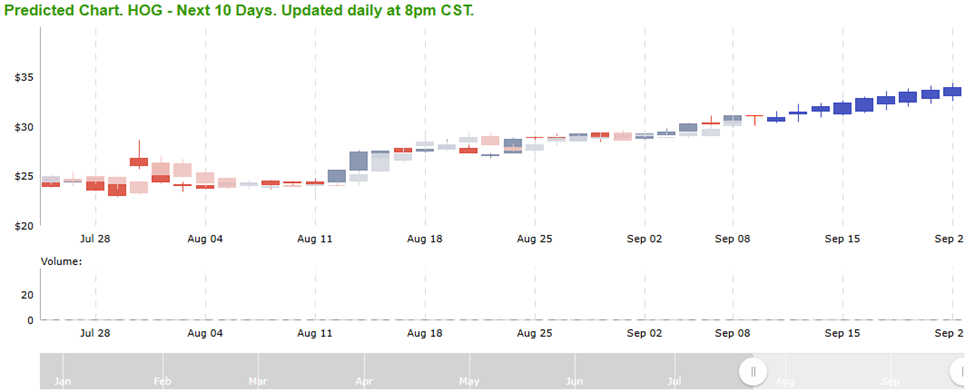

This week’s trade idea comes from Harley-Davidson (HOG):

HOG has been on a tear after bullish earnings that were followed with aggressive selling. And now, the Forecast Toolbox likes it:

With projected upside to $34 in the next 2 weeks, this is an exciting setup. The October 17h $31/$34 call spread is currently trading for $0.97. If the stock runs up to the AI-generated target over the next two weeks, that options trade would likely double if not better, and that’s an exciting opportunity in the current market environment.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

If you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments