After years of cyberattacks, the world is still unprepared.

And unfortunately, cyber criminals will continue to take advantage of it.

Not only do we face consistent attacks in the U.S., Europe was just nailed with an attack on check-in technology company Collins Aerospace, which affected the UK’s biggest airport, Heathrow, and airports in Berlin and Brussels.

“Aviation analytics provider Cirium told CNBC that on Sunday so far, 38 departures and 33 arrivals had been canceled across Heathrow, Berlin and Brussels, as of 10 a.m. London time. On Saturday, 35 departures and 25 arrivals were canceled. Brussels saw the highest number of flight cancellations, at 15,” as noted by CNBC.

Other than that, Jaguar Land Rover said it was extending a pause in production until September 24 following a cyberattack. “We have taken this decision as our forensic investigation of the cyber incident continues, and as we consider the different stages of the controlled restart of our global operations, which will take time,” the company said in a statement.

Unfortunately, attacks like these will continue because the world is still poorly prepared.

We can trade the chaos, though, with ETFs such as:

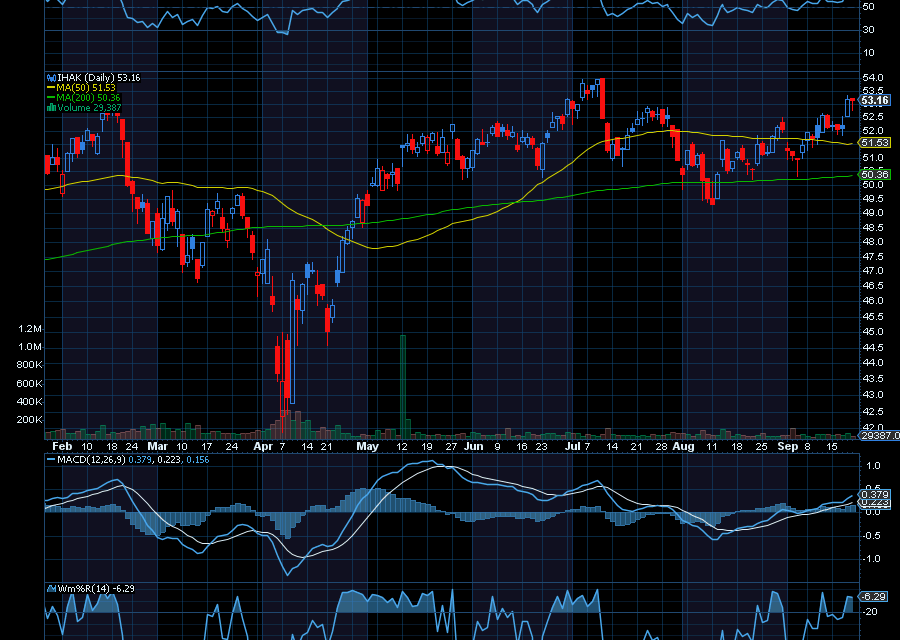

iShares Cybersecurity and Tech ETF (IHAK)

With an expense ratio of 0.47%, the IHAK ETF tracks companies involved in cyber security and technology, including cyber security hardware, software, and products. Some of its top holdings include Cyber Ark, CrowdStrike, and Palo Alto, to name a few of its 33 holdings.

While IHAK is a bit overbought at current prices, we do believe it could push even higher with cyberattacks showing no signs of cooling off. Plus, we may soon have to deal with quantum computing threats. In fact, as exciting as quantum computing may sound, it could also have a severe, negative impact on just about every part of everyday lives including banking systems, email communications, cryptocurrencies, communications,AI systems, and national defense.

Sincerely,

Ian Cooper

Recent Comments