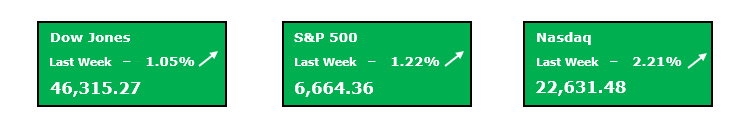

Equity market investors continue to reap the rewards as stock prices once again rally to new all-time highs! As we mentioned headed into last week, the market’s focus was squarely set on rate cuts and finally getting that first cut that it had been waiting for. Of course, on Wednesday, as expected, the Fed opted to lower their policy rate delivering to stock market investors precisely what they wanted. Now, because stocks had rallied so much headed into that meeting, the rate cut had largely already been priced in so in the immediate aftermath following the Fed’s decision, markets sold off slightly. However, in Thursday and Friday’s trading to close out the week markets broadly rallied, making numerous new all-time highs. In Thursday’s trading we notched new all-time highs in all four major US indexes, S&P 500, Nasdaq, Dow Jones, & the Russell 2000. Then in Friday’s trading all of these except the Russell made another subsequent new high displaying investor’s enthusiasm and hopes that Wednesday’s cut was marking the beginning of a new rate cutting cycle. Now, we fully expect that at least until the next earnings season that the market is going to remain focused on the interest rate question. There have been so many pockets of the market that have rallied over the past several months in anticipation of a rate cutting cycle. Because of this, the market will likely need this assumption to play out or risk giving back some of these recently found gains. So even though the Fed has finally decided on the first cut, expect that markets will be reacting to each relevant economic report based on whether it either supports or detracts from the rate cutting case. Regardless, at this point markets are trading near all-time highs, and this is no accident. Earnings growth has remained stronger than the Street expected, GDP is still tracking along well, the Fed is cutting rates, and I could go on, but all this to say is that even though there are some risks still on the horizon, there sure is a lot that is going right for stocks and this should continue to be supportive for equity prices through the end of the year barring any surprises.

With markets essentially across the board breaking out to the new all-time highs, as one may guess the technicals and market internals do look quite strong for this market, but let’s dive in. With the S&P 500 closing at a new record in Friday’s session, the index is trading well above all significant trendlines that we track, so the overall trend for the market is about as strong as it gets. Now, despite the impressive strength shown in the headline index, the equal weighted version and the market internals tell a slightly less impressive story. Even though the headline S&P broke out to several new highs last week, this was not reciprocated by the equal weighted index. The equal weighted index is still only marginally off of its all-time highs, yet it did not participate in the strong upside trading last week. Additionally, the Advance Decline index for the S&P 500 did not break out to a new high last week and remains slightly below its recent high. So, while we did not see a breakdown in breadth and the internals per say, they did not quite confirm the massive move higher that we enjoyed last week. In the weeks to come it will be a positive sign if we can get the equal weighted S&P 500 to also begin to enjoy a stretch of new all-time highs once again. Headed into this week, on the back of last week’s major move higher, the headline index does find itself in short-term overbought territory. Looking at a chart of the S&P whether it be daily or weekly, the index has now remained above the upper Keltner Channel for some time and our short-term RSI is reading a red hot 85.6. Each of these signal that the index is likely due for a few days of cooling, allowing the recent gains to consolidate before moving higher from here. We do not expect a major drop but we do expect to see the markets give back some of the recent gain during this week’s trading. We are approaching this week with this cautious outlook, expecting stocks to retrace back into the Keltner Channels and at this point we will be scanning for new opportunities.

⚡ Special Promo: First Month Access for Only 1$⚡

Have you joined my Weekly Profit Opportunity newsletter yet? If not, then you just missed out on a recent trade alert I sent to members that has risen 153.4% in just a few weeks! While past results do not guarantee future returns, this newsletter features my top trade pick each week!

Key Events to Watch For

- PCE Inflation Report (Aug)

- Earnings Reports (MU & COST)

Following last week’s decision from the Fed to cut rates, which sent markets soaring to new highs, this week the board is being reset. We’ve gotten the first cut out of the way but still inflation and labor market weakness are at odds with one another. So, investors will be looking for any fresh data that can help to confirm that inflation is not accelerating, paving the way for the Fed to continue to lower rates at the upcoming meetings. This week will deliver one of these crucial data points as the August PCE inflation report will be released on Friday during the pre-market. The expectation is that core PCE will remain somewhat contained, but still coming in at 2.9%. Investors will be hoping for this report to produce a result either in line with expectations or a downside surprise would be more than welcome also. Markets are likely to be focused on this report for much of the week headed into Friday.

Q2 earnings season is effectively all but behind us, however, there are always a handful of significant companies that report much later on. This week will feature the earnings reports from two such companies. On Tuesday, Micron Technologies (MU) will release their earnings numbers after the bell. MU, of course a major player in memory chips, is an key party in the A.I. buildout, so this report will provide further insights in the A.I. trade. Then, later in the week, Costco Wholesale (COST) will report their Q2 numbers after the bell on Thursday. COST of course is one of the major retail businesses in the U.S. COST shares have been under a bit of pressure lately so investors will be looking for COST to report strong results and provide some clarity about how they are navigating the new tariff heavy environment.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments