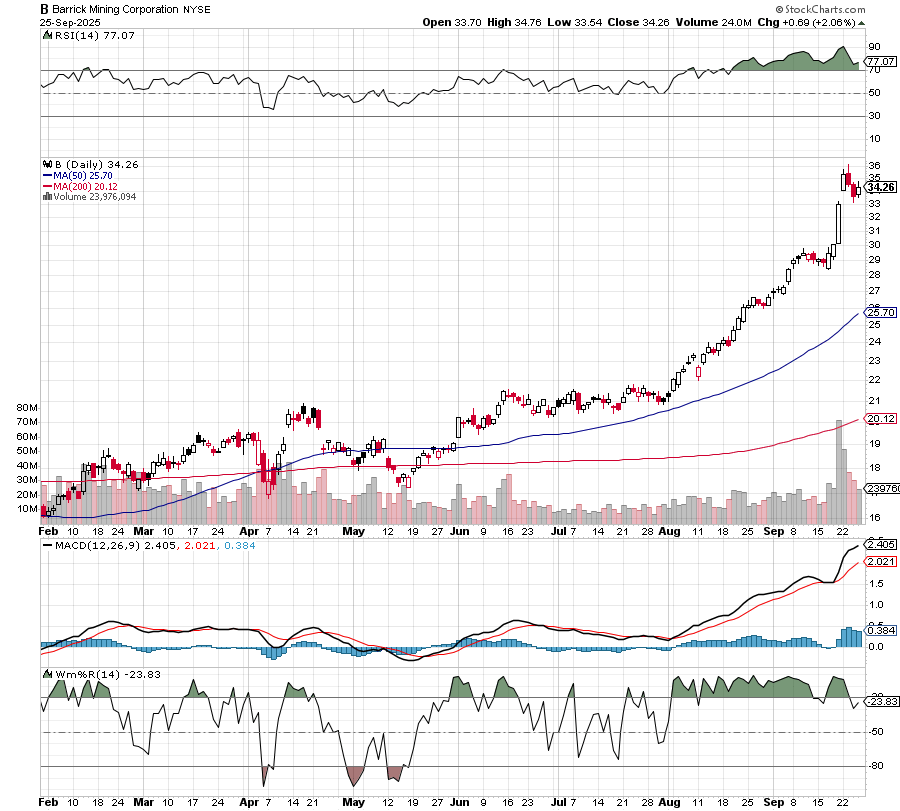

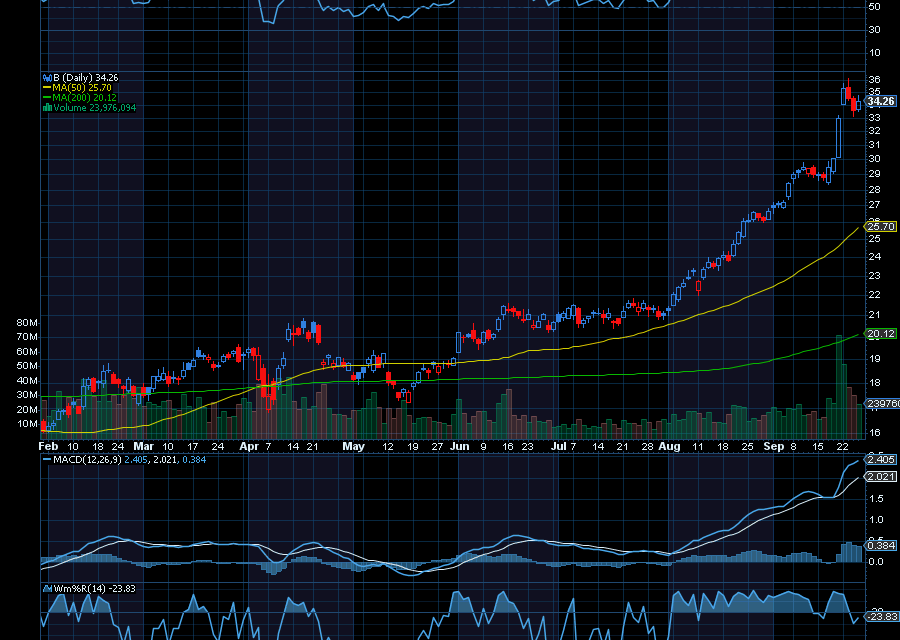

Earlier this month, we highlighted an opportunity in Barrick Gold (B), as it traded at $27. Today, it’s up to $33.60 and could rally even higher.

All as the price of gold continues to push aggressively higher. Last trading at $3,742,40, we still believe it could test $4,000 before the end of the year – especially with geopolitical and economic uncertainties, growing central bank demand, and more interest rate cuts.

Helping, China now wants to become a custodian of foreign sovereign gold reserves, meaning it wants to store gold bought by other countries.

According to Business Insider, “The move is bullish for the price of gold in two ways. First, it incentivizes more people — in this case, governments — to buy the metal. Second, by making it a national financial priority, China is establishing itself as yet another major player in a system designed to do one thing: keep buying and holding gold.”In addition, analysts at Deutsche Bank say that gold prices could soar above $4,000 by the end of the year. Analysts at Fidelity say the safe-haven metal could soar to $4,000 by the end of next year. Goldman Sachs and Bank of America are also calling for $4,000 gold by 2026.

Sincerely,

Ian Cooper

Recent Comments