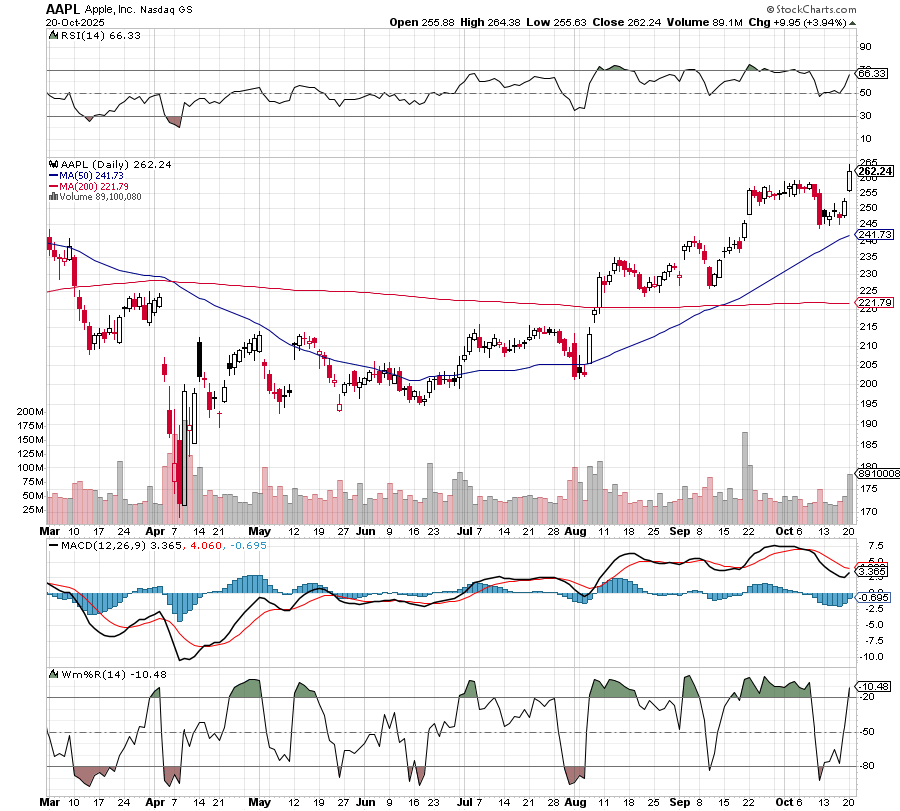

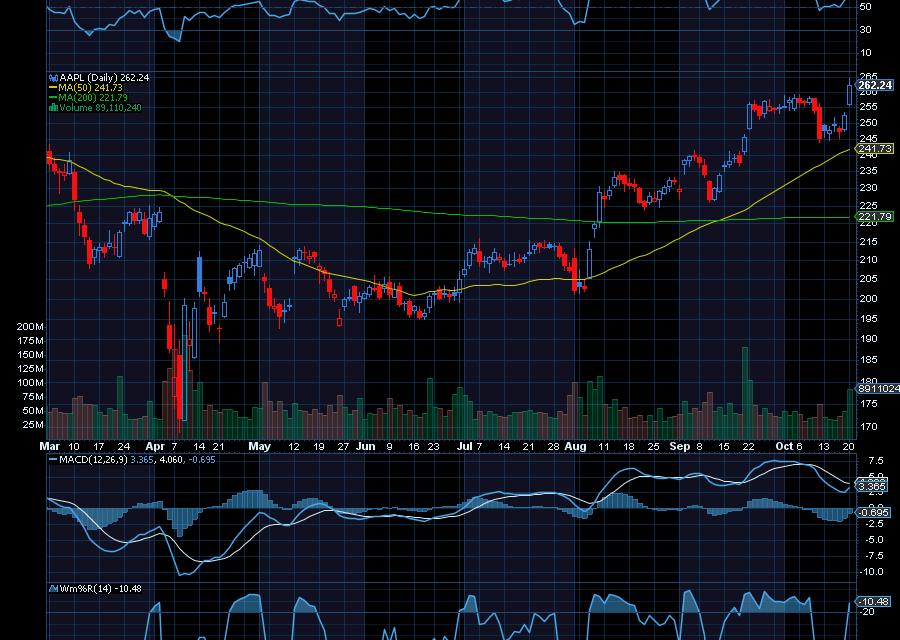

Apple is again a buy opportunity.

After pulling back from about $259 a share, Apple found support at $245, where it’s been consolidating. From its last traded price of $252.29, we’d like to see the tech giant rally back to $259 initially. Helping, new iPhone 17 sales are outpacing iPhone 16 sales by 14% during the first 10 days on availability in the U.S. and China.

“We see shares getting a lift into 2026 and into a Siri/product event in the March 2026 time frame. Apple’s Siri update has been delayed but it’s about to get better with significant AI enhancements, transitioning from a basic voice assistant to a more intelligent, context-aware, and humanlike interface, aligning with Apple’s robotics and smart home ambitions,” wrote Melius Research analysts said, as quoted by Barron’s.

The firm has a buy rating on Apple with a $290 price target.

Bank of America also has a buy rating on the Apple stock with a $270 price target. The firm cited “strong capital returns, eventual winner on AI at the edge and optionality from new products/markets” as key factors behind the buy rating, as noted by Insider Monkey.

Sincerely,

Ian Cooper

Recent Comments