Always keep track of stock splits.

While splits don’t change the value of a stock, they can serve as a positive signal. This can then lead to further liquidity and more investor interest. After all, if an attractive $500 stock were to split 10:1, more investors are likely to jump in.

Plus, according to Morningstar.com, “Splits matter – because these stocks outperform after the announcement, by a lot. Average returns one year later are 25% vs. 12% for the S&P 500 SPX as a whole, say researchers at Bank of America. It’s worth brushing up on stock splits now, for two reasons. Stock splits are picking up again after a decade-long lull.”

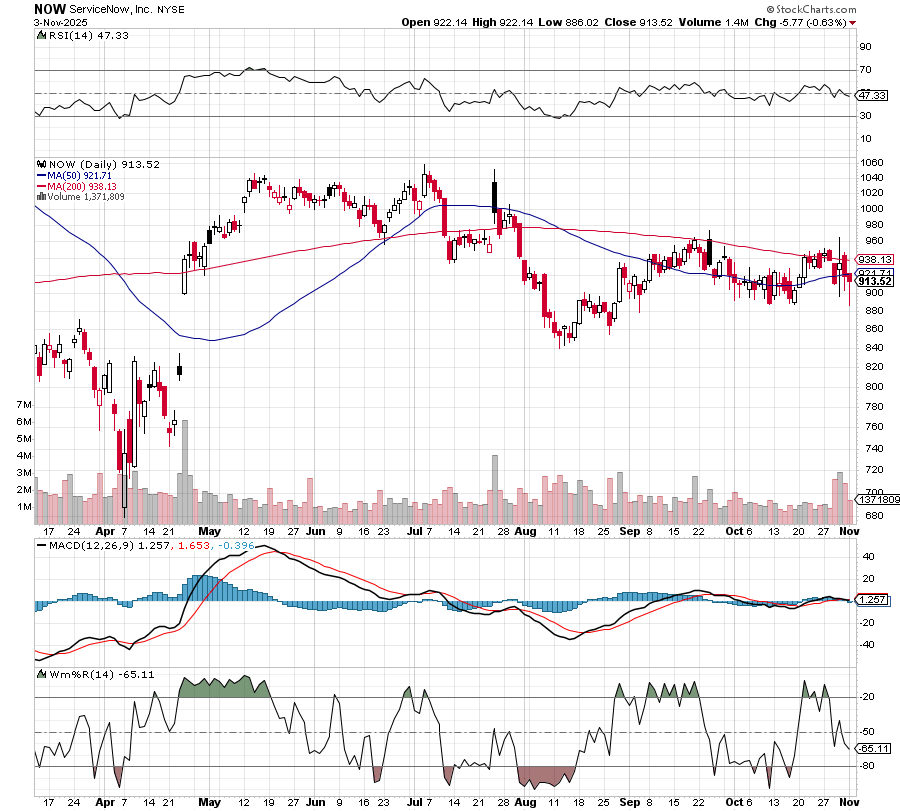

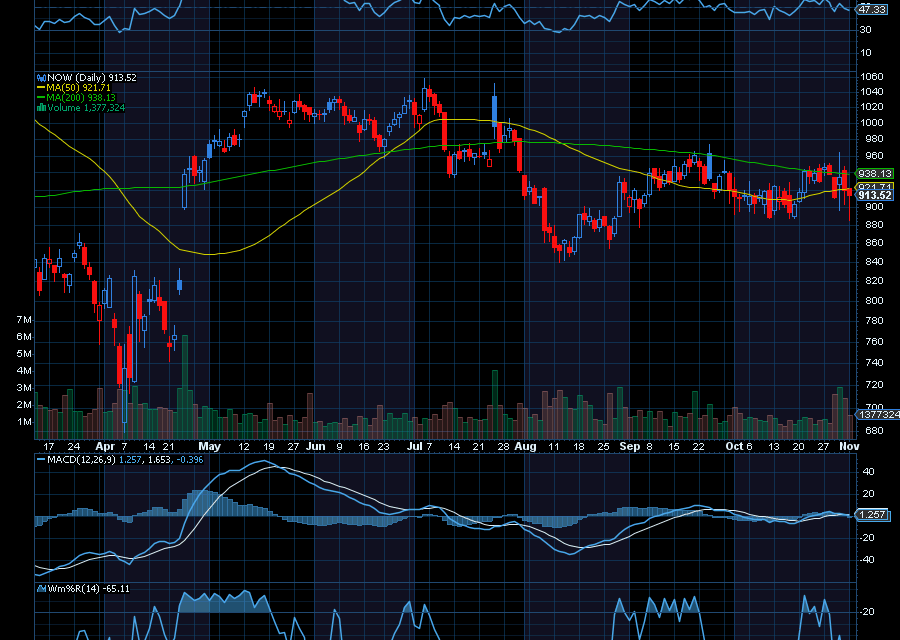

Look at ServiceNow (NOW).

At $929 a share, NOW just announced a 5-for-1 stock split. As noted by CNBC, “ServiceNow’s board also approved a five-for-one stock split slated for the beginning of December. [CEO Bill] Mastantuono said the split will make shares accessible to more retail investors.”

NOW also topped earnings estimates.

Its EPS of $4.82 beat estimates of $4.27. Revenue of $3.41 billion beat estimates of $3.35 billion. It also increased its full-year guidance, now expecting subscription revenue to range between $12.84 billion and $12.85 billion. Last quarter, the company raised FY guidance to a range of $12.78 billion to $12.80 billion.

Sincerely,

Ian Cooper

Recent Comments