Palantir earnings are being blamed for Tuesday’s market action, and there’s a lot of uncertainty in whether this is a buyable dip or the start of something worse, once again. In other words, AI just put a bit of a scare into the market, and I’m going to use AI to help navigate the fallout.

But I’m not using Palantir to figure this out, I’m using the AI-powered Forecast Toolbox!

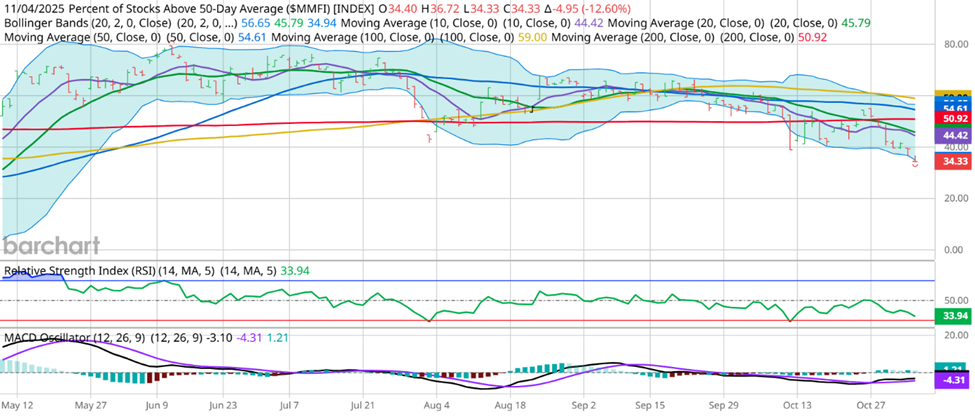

One of my biggest concerns with this market has been the lack of market participation in the rally, and that’s still certainly the case today. In fact, the percentage of stocks above their 50-Day Moving Average right now is teetering on a reading normally tied to a bear market (30% or lower):

So what do I do in this type of situation? The market looks like it’s been in a bearish trend when I look at participation, but the S&P 500 is still near all-time highs, so it’s a very unclear picture.

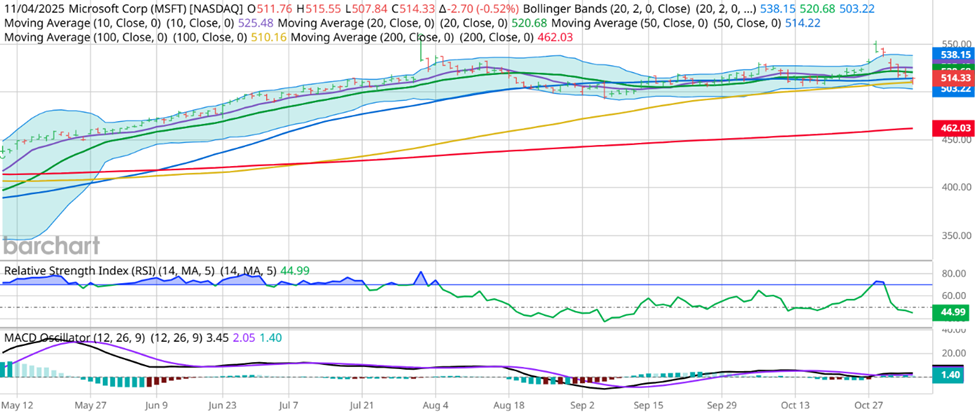

When I looked through the Forecast Toolbox to identify an opportunity, it became clearer and clearer that one of the best looking setups for me right now is in Microsoft (MSFT):

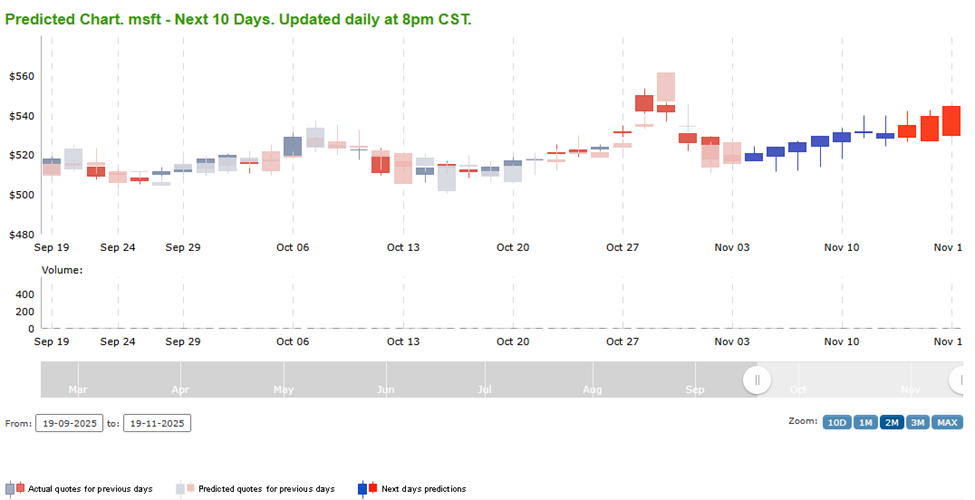

Microsoft has strong technical support at the 100-Day Moving Average that also aligns with the mid-October lows. On top of this, I see a strong forecast of limited downside in the near future:

Combining a technical setup of strong support seen by both the technical chart analysis and the AI analysis, I can turn again to a defined risk structure of a put credit spread, as I have done many times in the recent past due to the uncertainty of whether stocks need to go higher or simply seem to have a tough time going much lower.

For Microsoft, I’ll use that $505 support as my starting point, and look at the November 14th, 2025 $505/$502.5 put credit spread. This position is the simultaneous sale of the November 14th $505 put and purchase of the $502.5 put, which defined my max risk to $2.50 minus the initial premium collected, which is currently $0.61. That means my return on risk for this trade is 32% as long as MSFT closes above $505 on November 14th, and that looks like a good setup to me!

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments