More Americans are renting again.

In fact, as noted by Fortune.com, “For the first time since 2016, America’s homeownership rate has tipped into negative territory, signaling a subtle but profound shift in the nation’s housing dynamics, Redfin reports in its new analysis of U.S. Census Bureau data. In the second quarter of 2025, the number of U.S. homeowner households fell ever so slightly, by 0.1% year over year to 86.2 million, while renter households surged by 2.6% to 46.4 million—one of the largest increases in recent memory.”

That tells us homeowner growth isn’t growing much, if at all.

All because of rising home prices, high mortgage rates, and economic uncertainty. As investors, we can profit from stock appreciation and dividends from those higher rent numbers with real estate investment trusts (REITs).

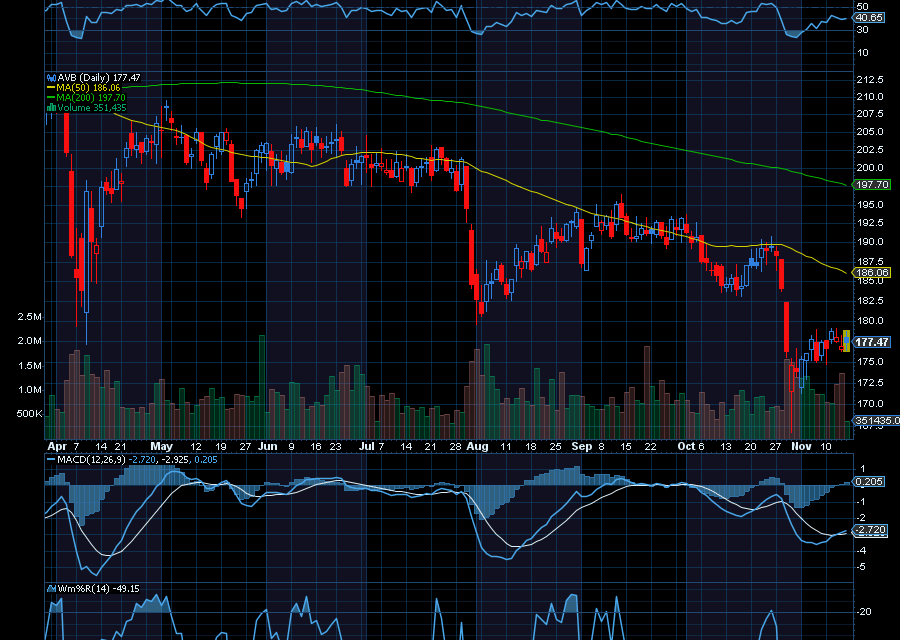

Look at AvalonBay Communities (AVB)

With a yield of 4.02%, AVB is an equity REIT in the business of developing, redeveloping, acquiring and managing apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California.

The Company owned or held a direct or indirect ownership interest in 3315 apartment communities containing 97,212 apartment homes in 11 states and the District of Columbia, of which 20 communities were under development.

It also just paid a dividend of $1.75 a share on October 15.

Sincerely,

Ian Cooper

Recent Comments