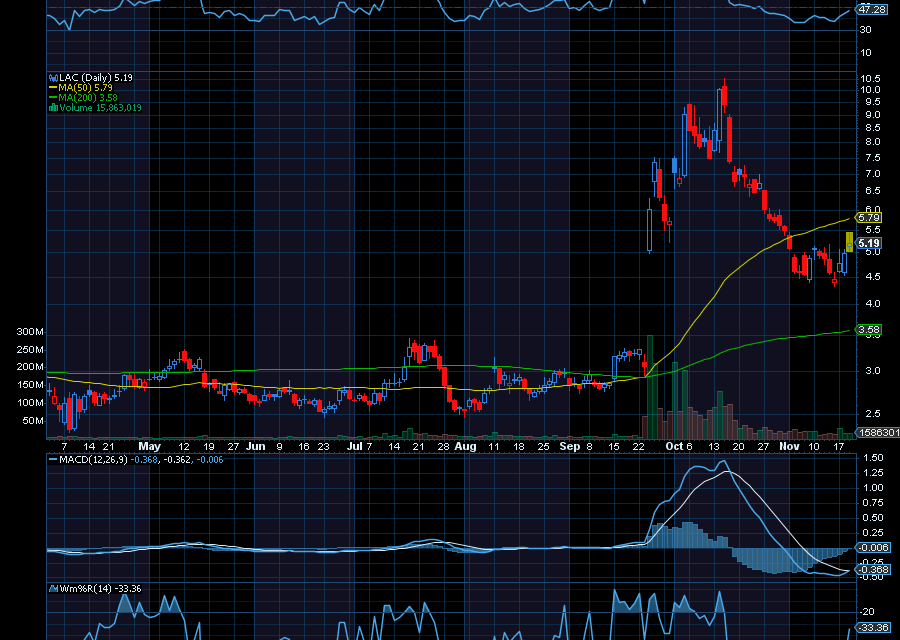

Keep an eye on oversold shares of Lithium Americas (LAC).

Last trading just under $5 a share, it’s now oversold and starting to reverse higher on RSI, MACD, and Williams’ %R. From here, we’d like to see it initially retest $7.50. Fueling upside, Li Liangbin, chairman of Ganfeng Lithium, said he expects for lithium to grow about 30% in 2026.

In fact, as noted by Seeking Alpha, “Li said demand growth could drive the lithium carbonate price above 150,000 yuan/ton, or even to 200,000 yuan/ton, in which case, supply would not be able to keep up in the short term, despite the market’s ~200,000 tons surplus this year. “Prices already have been rising recently in China, with a 17% rally this month, as investors predict booming demand from the energy storage sector.”

In addition, according to Albemarle CEO Kent Masters, lithium is also becoming an AI trade opportunity. As quoted by Investors.com, “North America is the fastest-growing region for stationary storage, up almost 150% year-to-date, as rising data center and AI investment in the United States increases the demand for electricity and grid stability.”

In short, it’s time to go long lithium again, especially with oversold stocks like LAC.

Sincerely,

Ian Cooper

Recent Comments