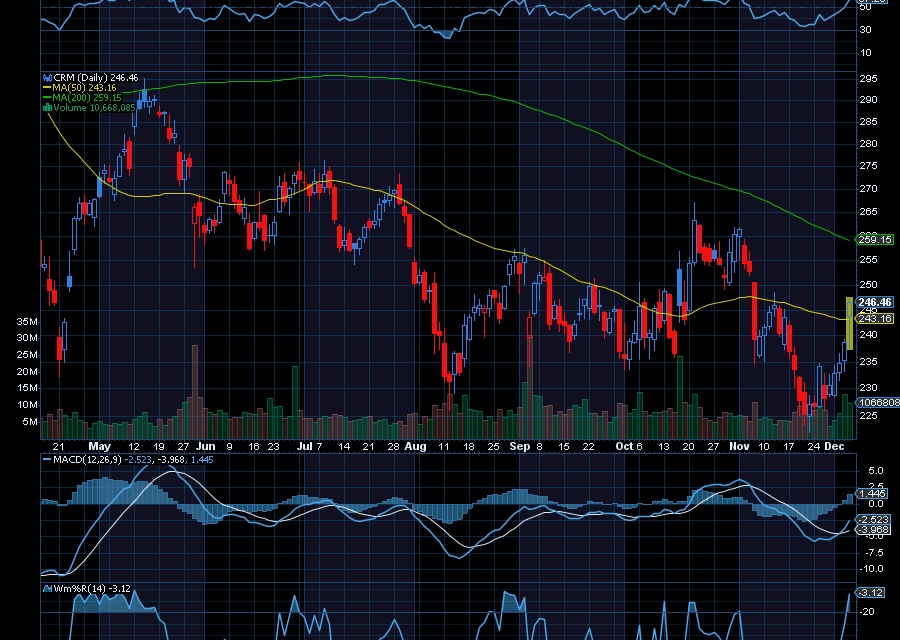

Keep an eye on beaten down shares of Salesforce (CRM).

Goldman Sachs just reiterated its buy rating on the stock following earnings.

As noted by the firm, it now has a $385 price target following CRM earnings, especially with revenue and guidance in line with expectations. EPS of $3.25 bet estimates by 39 cents. Revenue of $10.26 billion, up 8.7% year over year, was in line with estimates.

In its most recent quarter, CRM EPS of $3.25 beat estimates by 39 cents. Revenue of $10.26 billion, up 8.7% year over year, was In line with estimates. Moving forward, CRM Q4 revenue is expected to come in between $11.13 billion and $11.23 billion. Adjusted EPS is forecast to come in between $3.02 and $3.04, which is in line with estimates of $3.03.

Salesforce also increased its forecast for fiscal 2026.

It now sees revenue of between $41.145 billion and $41.55 billion, which is above its previous range of $41.1 billion and $41.3 billion. Salesforce also expects to earn between $11.75 and $11.77 per share on an adjusted basis, above its previous forecast of $11.33 to $11.37 per share. Analysts were expecting $11.37 per share.

In addition, analysts at Wedbush reiterated an outperform rating on CRM with a $375 price target. Evercore reiterated an outperform rating with a $340 price target. Morgan Stanley reiterated an overweight rating on CRM with a $405 price target. Wells Fargo analysts reiterated an equal weight rating on CRM with a $265 price target.

Sincerely,

Ian Cooper

Recent Comments