As 2025 comes to a close, I wanted to provide a bit of insight into a common strategy for the new year to help you all prepare for upcoming opportunities.

As traders and investors alike review new positional ideas, a common strategy that is implemented is also a quite simple one: the dogs of the DOW.

The strategy is as follows: at the beginning of each new year, buy the 10 DOW stocks with the highest dividend yield, and hold for the year. That’s it. Simple, right?

Well, as simple as it is, not many of us like to hold positions for a full year, and we’re looking to actively time the market then move money into more dynamic opportunities. So, to get a clean view of how this worked in early 2025 as an example, let’s look at the 3 highest dividend yield stocks in the DOW Jones Industrial Average and how they performed in the first two months of 2025 (performance including dividend yield) relative to the DOW Jones Industrial Average:

Verizon (VZ): 6.78% yield as of 12/31/2024, up 9.5% in January and February

Chevron (CVX): 4.50% yield as of 12/31/2024, up 10.7% in January and February

Amgen (AMGN): 3.65% yield as of 12/31/2024, up 19.1% in January and February

DOW Jones Industrial Average: up 3.2% in January and February

With that clear superior performance in the first 2 months of the year coming from the dogs of the DOW, I want to be ready for what may be repeated for 2026, and so, without further ado, the top 3 dividend yield stocks for the DOW Jones Industrial Average as of the market close on 12/22/2025:

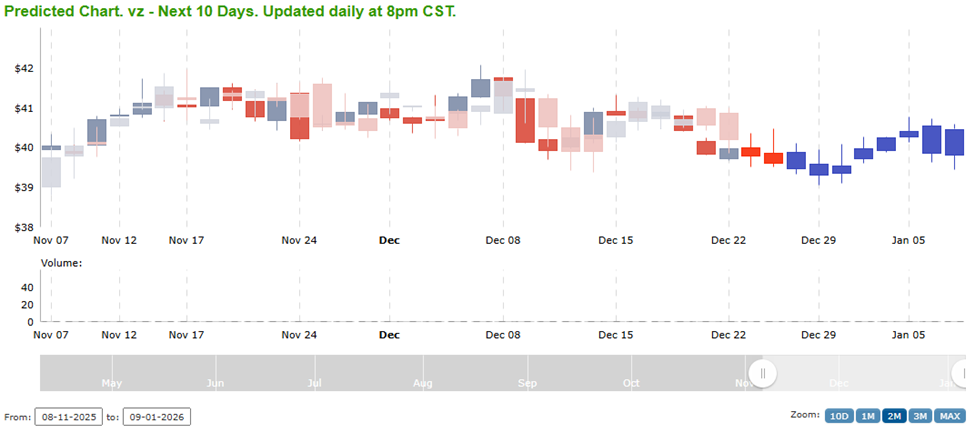

Verizon (VZ): 6.84% yield as of 12/22/2025

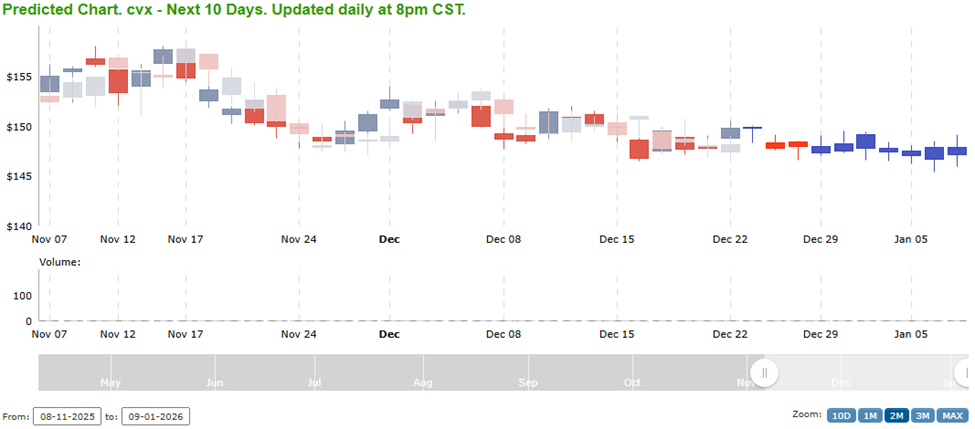

Chevron (CVX): 4.55% yield as of 12/22/2025

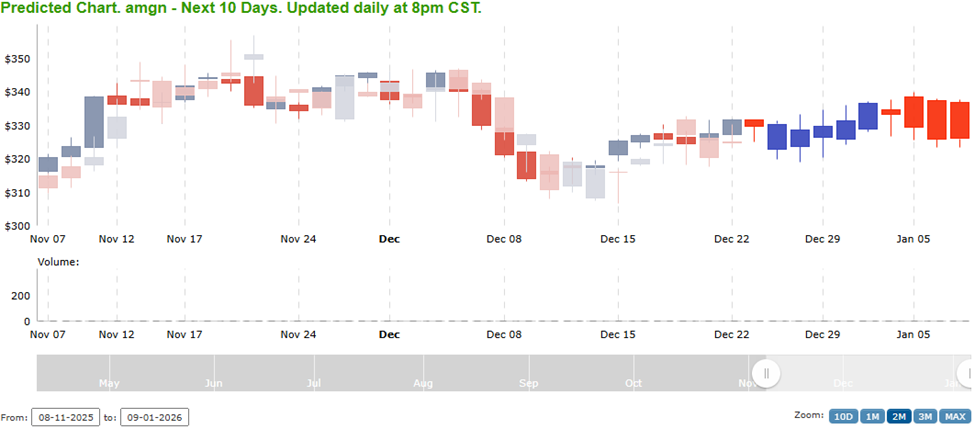

Merck (MRK): 3.16% yield as of 12/22/2025

And to get a sense of how these stocks look now in terms of money flow, I look at the Stock Forecast Toolbox, as this will give me a sense of if investors are already buying now and how they are projected to perform in the final week of 2025 so I know if I should get into buying right now:

Looking at the AI projected moves over the next 2 weeks, it looks like there’s limited expected downside, but no immediate urgency, so I can more likely buy into over time. That’s a good spot to be in when building a position that I expect the investment community to focus in on in the coming 2 months. That’s the great thing about having a tool like the Forecast Toolbox – I can do further due diligence to determine not just what stocks are projected to go up by AI models, but I can also use separate analysis to determine a stock I’m looking to buy into and find out how urgently I need to execute my idea to avoid missing out!

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments