Americans love to bet on sports.

Look at the Super Bowl, for example.

According to the American Gaming Association, $7.61 billion was bet on the Super Bowl in 2021. In 2022, the AGA estimated that more than $8 billion would be wagered. In 2023, $16 billion was wagered. In 2024, about $23.1 billion. In 2025, nearly $30 billion. With the 2026 Super Bowl set for early February, we expect to see another round of big numbers.

To trade the 2026 Super Bowl, investors may want to start jumping into related stocks now.

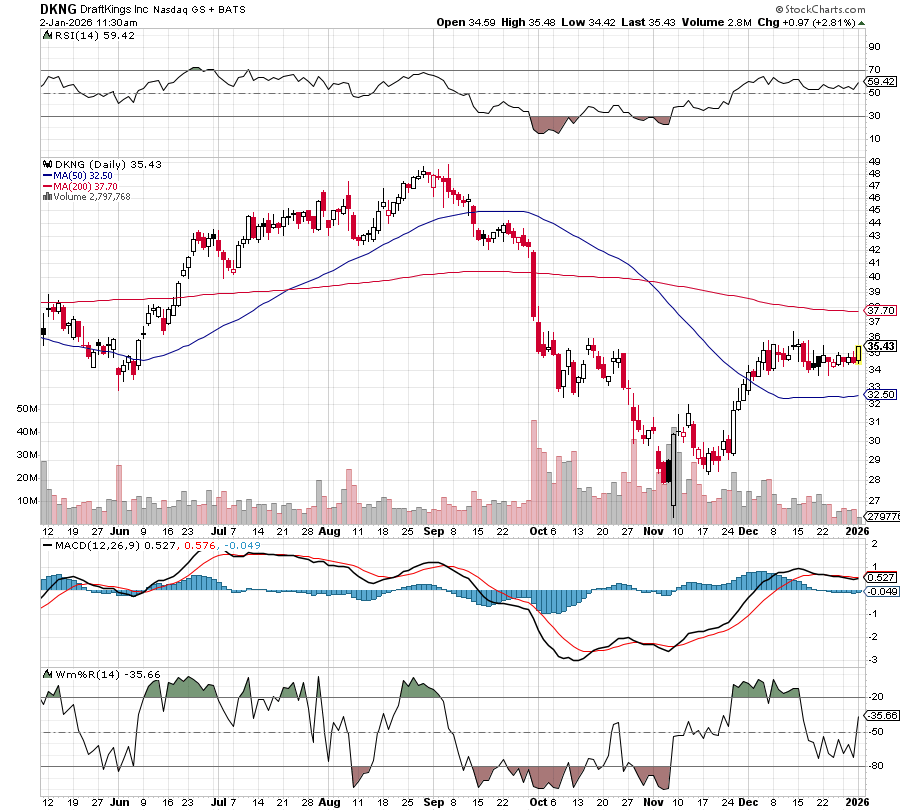

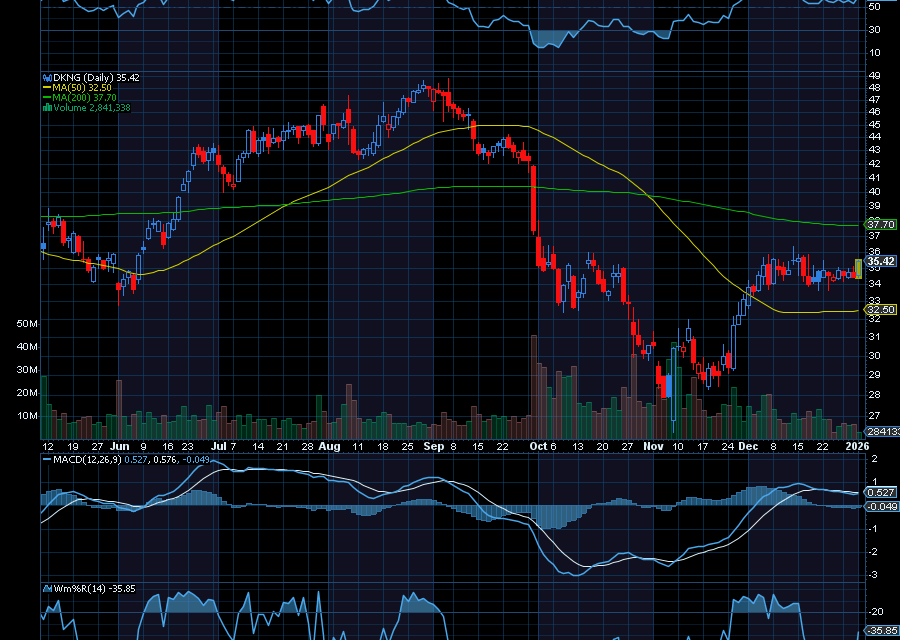

DraftKings (DKNG)

DraftKings stock saw a bump ahead of the Super Bowl over the last few years. In 2024, DKNG ran from a January low of about $32 to a high of $45.62 after the game. In early January 2025, DKNG ran from about $17.60 to $20.88.

Today, DKNG trades at $21.08, where it’s been consolidating for a few days now. From here, we’d like to see DKNG break higher with a potential test of $23 a share.

YieldMax DKNG Option Income Strategy ETF (DRAY)

With an expense ratio of 0.99%, the YieldMax DKNG Option Income Strategy ETF (DRAY) last traded at $31.35 and is likely to gain traction ahead of the 2026 Super Bowl.

While the fund does not directly invest in DraftKings, it does generate monthly income by selling/writing call options on DKNG. Even better, it pays a weekly dividend. On January 5, it’s paying a dividend of just over 30 cents a share. On December 29, it paid just over 33 cents. On December 19, it paid just over 43 cents. On December 12, it paid just over 38 cents.

Flutter Entertainment (FLUT)

Even Flutter Entertainment has been a solid Super Bowl bet. In 2024, FLUT ran from a January low of about $160 to a high of just $220.78. In January 2025, it ran from a low of about $260 to $300. At the moment, it’s also oversold, just starting to pivot from support at $216.

Roundhill Sports Betting & iGaming ETF (BETZ)

Or, investors can jump into an ETF that invests in sports betting stocks. With an expense ratio of 0.75%, the $20.51 ETF offers diversification with Flutter Entertainment, Penn Entertainment DraftKings, Churchill Downs, MGM Resorts, and many more. What’s nice about an ETF is that it offers greater exposure at less cost. Last trading at $21.10, we’d like to see it run back to $24 a share initially.

Sincerely,

Ian Cooper

Recent Comments