If you want exposure to what elected officials are trading, there are two ways to do that. For one, you could always track down what each member of Congress is buying and selling and tag along, such as Nancy Pelosi.

Just this week, it was announced that Nancy Pelosi made a fortune trading options on Alphabet, Amazon, Apple, and Tempus AI. She also disclosed a new position in Alliance Bernstein (AB) acquiring 25,000 shares worth between $1,000,001 and $5M on Jan. 16.

And while you and I can try to mirror her returns, many times we’re not able to.

That’s because your elected officials don’t have to disclose what they bought for about 30 to 45 days after the transaction, per the STOCK Act.

Part of the STOCK Act “Amends the Ethics in Government Act of 1978 (EGA) to require specified individuals to file reports within 30 to 45 days after receiving notice of a purchase, sale, or exchange which exceeds $1,000 in stocks, bonds, commodities futures, and other forms of securities and subject to any waivers and exclusions.”

Instead, you can try to mirror what elected officials are trading by using two ETFs, including:

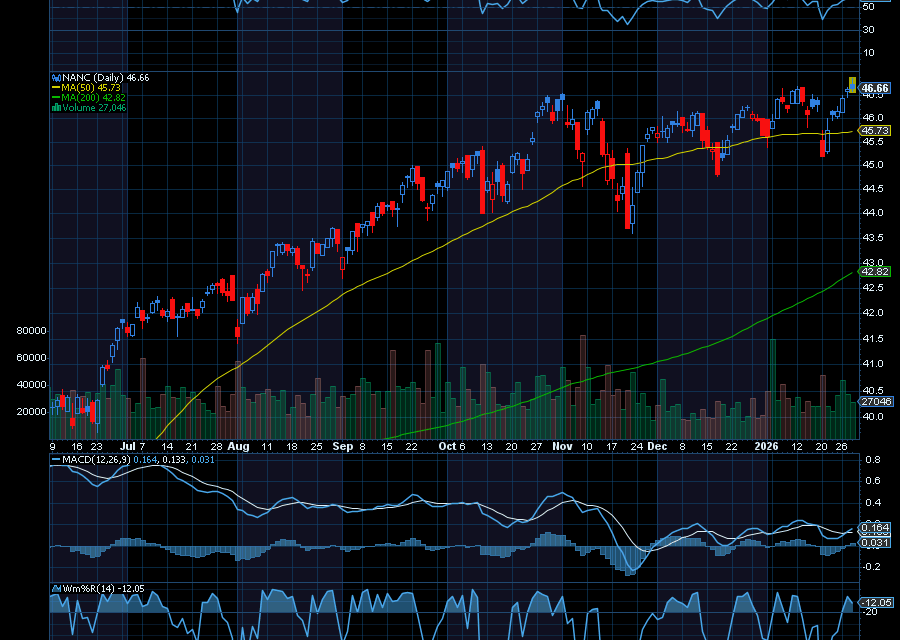

Unusual Whales Subversive Democratic ETF (NANC)

With an expense ratio of 0.74%, the Unusual Whales Subversive Democratic ETF (SYM: NANC) invests in equity securities purchased or sold by Democratic members of Congress and their spouses.

According to the NANC ETF Fact Sheet, “We have partnered with Unusual Whales to develop an ETF that will allow investors access to the near- real-time trading disclosures of members of Congress in both parties. NANC focuses on the Democratic Party. “

Unusual Whales Subversive Republican ETF (GOP)

With an expense ratio of 0.74%, the Unusual Whales Subversive Republican ETF (SYM: GOP) invests in equity securities purchased or sold by Republican members of Congress and their spouses. Some of its top stock holdings include JPMorgan, iShares Bitcoin Trust ETF, AT&T, Chevron, Nvidia, Intel, and Tyson Foods to name a few.

Sincerely,

Ian Cooper

Recent Comments