Always keep an eye on insider buying.

After all, if company insiders are putting their money where their mouths are, it’s a sign of confidence.

Look at Abbott Laboratories (ABT).

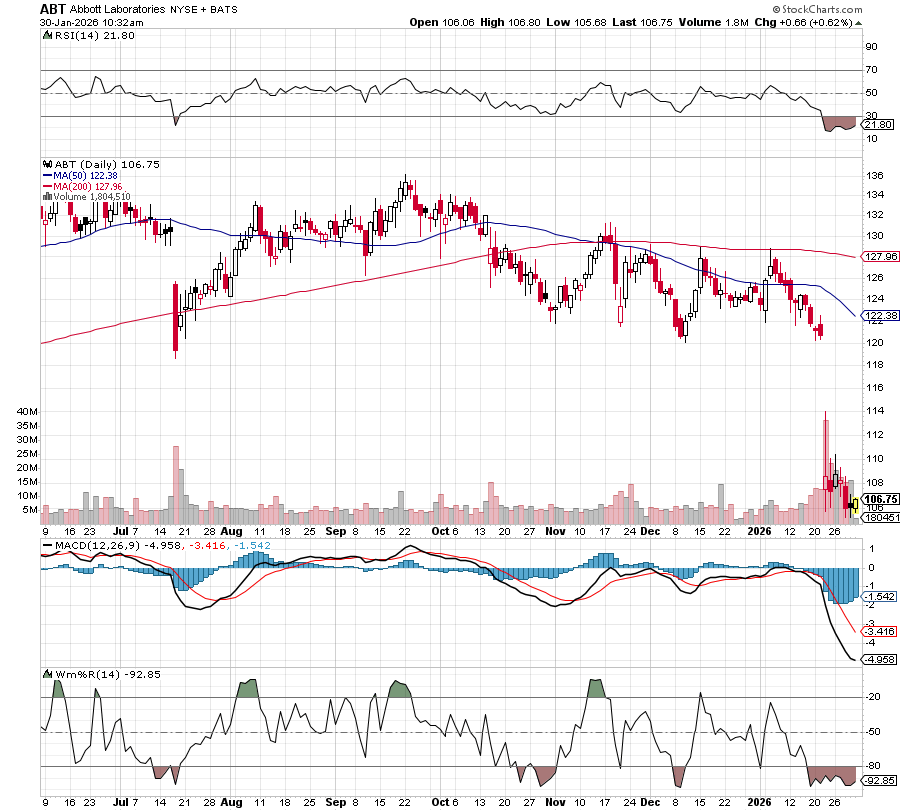

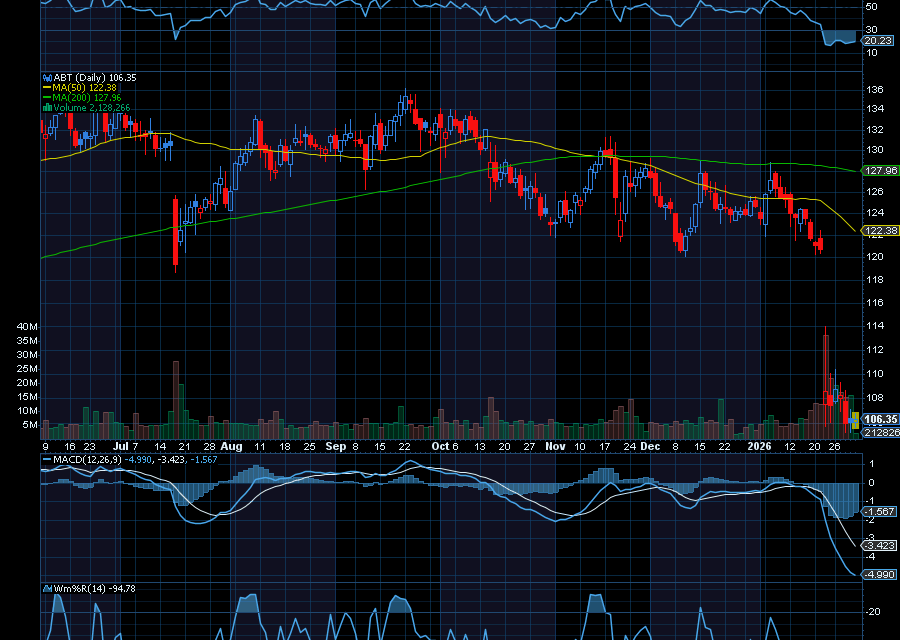

The stock fell sharply following its latest earnings report. In fact, it had its worst showing in more than 20 years, gapping from about $120 to $105.60.

Granted, the company’s adjusted earnings beat analysts’ forecasts by a penny, but sales came to $11.5 billion, missing the $11.8 billion estimate. It was a disaster. However, for Chairman and CEO Robert Ford, it was an opportunity. After the drop, he reportedly bought 18,800 shares of ABT for just over $2 million on January 23.Plus, despite the earnings mess, Ford did say Abbott was well-positioned for accelerating growth in 2026. “While we know we’ve got some work to do in nutrition, I can guarantee you that we’re not distracted by that,” he added, as quoted by Barron’s.

Sincerely,

Ian Cooper

Recent Comments