Keep an eye on Microsoft (MSFT).

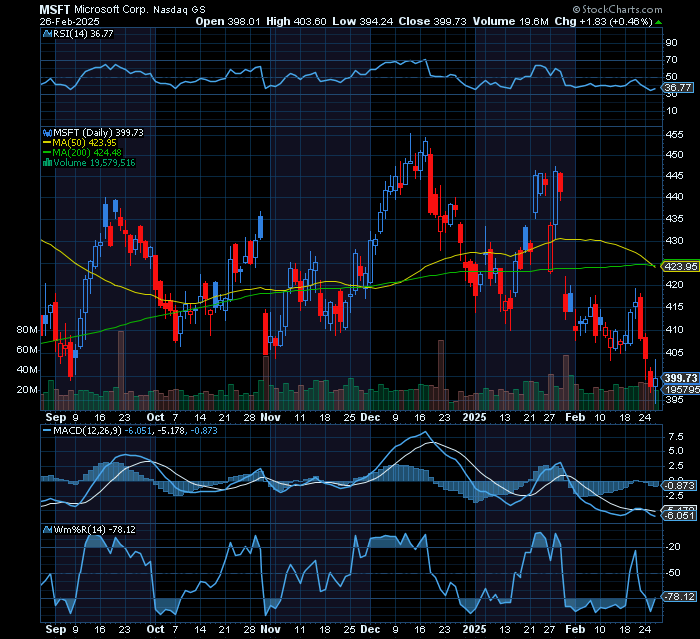

It’s wildly oversold at double bottom support dating back to August. It’s also over-extended on RSI, MACD, Williams’ %R and Full Stochastics.

In addition, according to the company, its $80 billion in planned spending on data center infrastructure is still “on track” this year, in response to a report issued by TD Cowen that it may be canceling some leases. “Thanks to the significant investments we have made up to this point, we are well positioned to meet our current and increasing customer demand,” said Microsoft, as quoted by Seeking Alpha.

“Last year alone, we added more capacity than any prior year in history. While we may strategically pace or adjust our infrastructure in some areas, we will continue to grow strongly in all regions. This allows us to invest and allocate resources to growth areas for our future. Our plans to spend over $80B on infrastructure this FY remains on track as we continue to grow at a record pace to meet customer demand.”

Analysts at Roth also said investors were “misreading” reports that Microsoft had canceled the leases of at least two new data centers with a total capacity of 200MW. Plus, Bank of America reiterated a buy rating on the stock with a $510 price target.

Sincerely,

Ian Cooper

Recent Comments