Coal stocks are gaining momentum after the Trump administration ordered the Pentagon to purchase electricity from coal plants and announced funding for upgrades to coal facilities.

As noted by The New York Times, “Trump signed an executive order directing Defense Secretary Pete Hegseth to enter into long-term contracts with coal plants across the country to power military installations. The move could provide financial support to dozens of coal plants that might have otherwise been set to retire in the coming years.”

He also directed the Department of Energy to issue funds to keep coal plants open in West Virginia, Ohio, North Carolina and Kentucky.

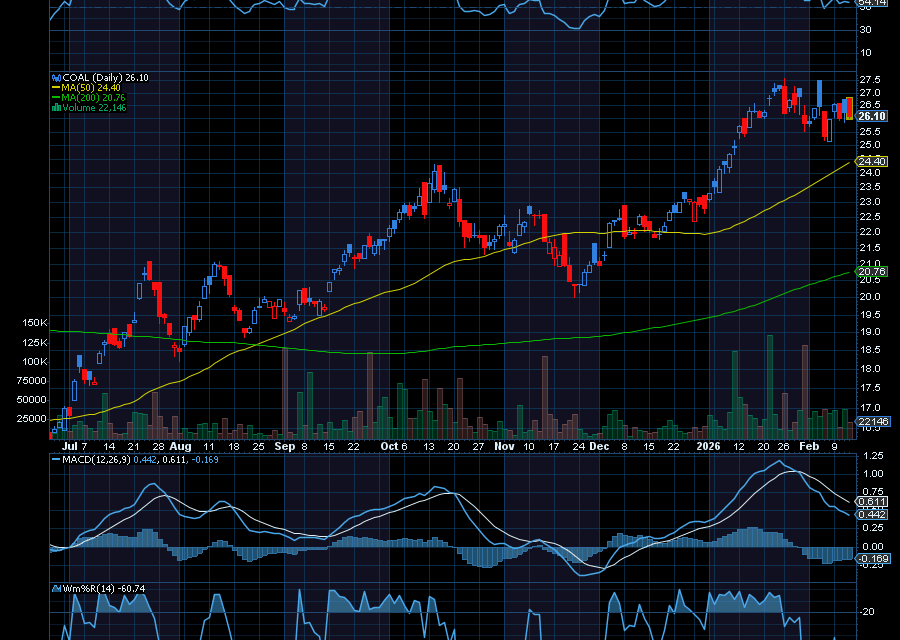

To trade that news, we can always invest in coal stocks, like Peabody Energy (BTU) and Hallador Energy (HNRG). Or, if you want greater exposure at a lower cost, there are exchange-traded funds such as the Range Global Coal ETF (COAL).

With an expense ratio of 0.85%, the COAL ETF was designed to track the performance of companies that are involved in the metallurgical and thermal coal industry, which includes production, exploration, development, transportation, and distribution.

Some of its 26 holdings include Warrior Met Coal, Alpha Metallurgical Resource, Peabody Energy, Glencore PLC, BHP Group, and Hallador Energy, to name a few. Plus, it pays out a yearly dividend, last paying out just over 59 cents per share on December 31. Before that, it paid out just over 37 cents per share on December 31, 2024.

Sincerely,

Ian Cooper

P.S. I have been tracking a way to exploit the rising volatility we are seeing and it has been working better than I expected. If you want to see how I am doing it, join me on Wed. Feb 18 at noon EST.

Recent Comments