Early strength across cyclicals continues to reveal a market that’s quietly favoring real-economy exposure over pure narrative-driven trades. Leadership has been broadening, with industrial and infrastructure-linked names pressing higher as capital rotates toward durable trends rather than short-term momentum bursts. That rotation has created a steady bid beneath select heavyweights, even on days when the broader indexes pause. The tape feels constructive, but increasingly selective.

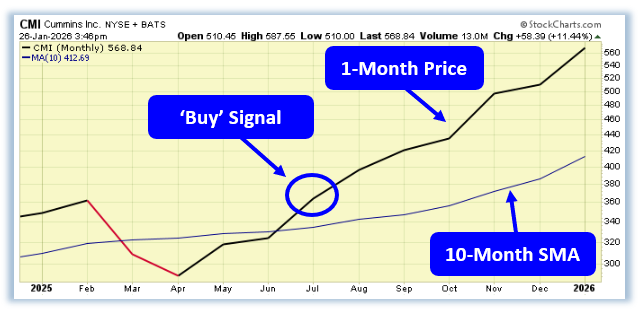

One name that fit squarely into that leadership profile was Cummins Inc. (CMI). The stock’s 1-month price remains firmly above its 10-month simple moving average, confirming a PowerTrend Buy signal that has been intact since the original crossover back in July ’25. That combination points to a sustained, higher-timeframe uptrend where pullbacks have tended to resolve higher rather than unwind. From a trader’s perspective, it’s the type of structure that rewards patience and disciplined positioning.

This is how our experienced traders look to generate steady income in any market 🔍— our Options for Income Newsletter delivers weekly income-focused setups, and you can try it for ONLY $1 your first month.

Given the stock’s elevated share price, defined-risk structures offer a cleaner way to express a bullish bias without committing excessive capital. An in-the-money call debit spread, for example, allows participation if the trend continues, while keeping risk clearly bounded. The setup is designed to benefit not only from continued upside, but also from a period of consolidation or even a moderate pullback, with a modeled profit potential of roughly 55% under favorable conditions by expiration. It’s a way to stay aligned with the trend while respecting capital efficiency.

If you want to dig deeper into how we’re thinking about this environment, today’s live session covered our broader 2026 market outlook, the launch of our new $100K Trading Income Challenge, and the exact framework we’re sharing with Private Wealth Group members. The full replay is now available for those who couldn’t attend. It’s a comprehensive walkthrough of how we’re positioning for the year ahead and I can promise you DON’T want to miss this!

Wishing You the Best in Investing Success,

Blane Markham

Chief Trading Strategist

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

Recent Comments