We have watched Dexcom (DXCM) on Market Wealth Daily many times. The recent pullback knocked it down a peg and it has started its recovery. It has been a strong performer and with it confirming a move over its 10 day moving average it is looking to head back up to continue its longer trend. This catch up move makes it a nice potential buy.

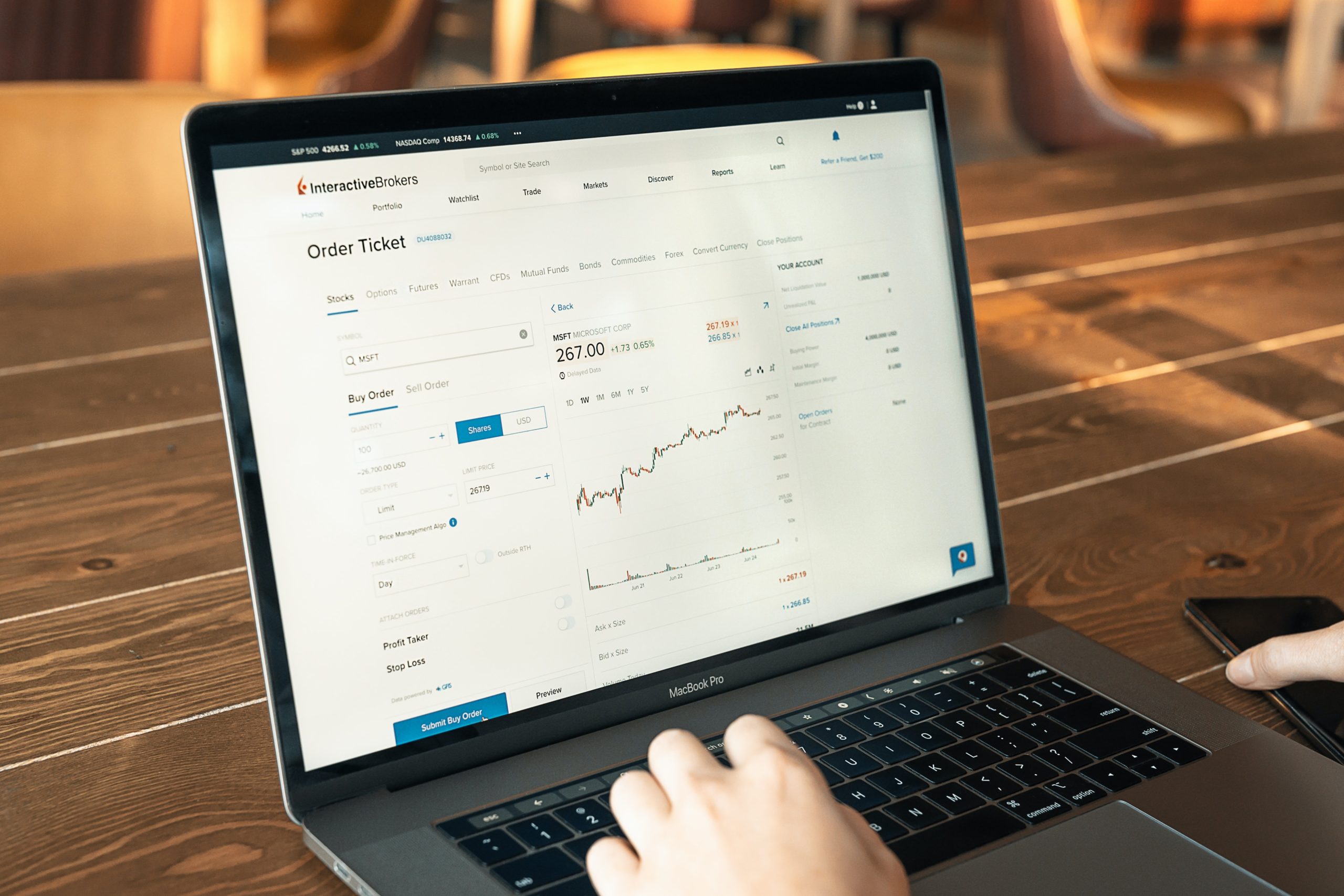

It also give us the opportunity to consider a way to boost the trade. Take a look at the chart:

Refilling to the previous trend would put DXCM at about 650, but there is a lot of room between where it is today, 566 and that mark. If we look at a call option with a strike of 600 and an expiration of January 21st, it is trading at about $16.30 this morning. We could realistically see it double if DXCM heads back up to the previous trend. At $16.30 it is a little higher than we would typically consider but this is a stock we have been watching and it has had consistent patterns. If this is too big of a chunk to bite off, definitely consider another trade.

Figuring out the best option strategy and if the risk vs potential reward is right for you is a key part to options trading. Grab a free copy of Chuck Hughes’ Option Trading Made Easy to get proven processes for finding, choosing and implementing the best option trades. Even if you have been trading options for a while, it is worth the quick read.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

PS-Wendy Kirkland is going to be walking through two of her most popular, and successful, trading approaches next Wednesday in an Investment Corner interview. If you have ever wanted to see how they work and hear your questions answered, this is your chance. Sign up here.

Recent Comments