Tech money flow continues to scare the market as we test a potential breakdown. And in saying that, I feel like a broken record.

This year, the broad market continues to see the same repeated pattern of testing lows, then new highs, then new lows for tech while the broad market holds up. Lather, rinse, repeat. Every dip feels like it’s the one that could break the market, and then the market finds a reason to rally.

But not everything rallies. AI names continue to drift lower, and big tech companies continue to see money out while smaller market cap companies pick up the slack.

Where does one invest when the market’s not doing what it did for years and tech is no longer safe? To answer that question, I turn to the Stock Forecast Toolbox!

As I search through charts, I see too much noise. But the toolbox gives me a curated list of stocks that are being bought now. The AI uses neural networks and concepts that are difficult to explain, but they work, and the model identifies what has the highest probability of success. So, when I’m not sure what I want to buy, or even feel sure what I want to buy, I rely on the toolbox to help guide me through these markets and provide increased confidence that my trade idea has a positive expected return.

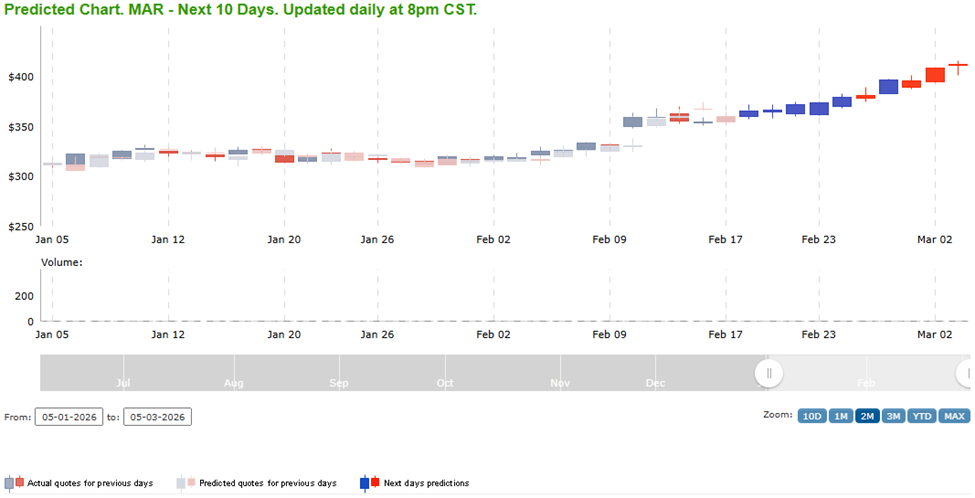

One name in particular caught my eye today, and not just because it’s going up. The forecast toolbox identified a pattern that I really like here with Marriott (MAR):

The stock had great earnings, and when I look back at the past few years, positive earnings sets a firm floor for weeks or even months. When the stock has weak earnings, there has been strong resistance, as well, but in the most recent earnings (last week), MAR had a bullish response to earnings, which I see as a strong signal of support for the near term.

When I look at the forecast toolbox’s projections, it’s quite bullish, and I can see why:

This is a setup where I would normally look for a bullish options trade, but recently, the market’s been reluctant to make those bullish ideas pay off. Since I want to increase my probability of success on the trade idea, I’ll look at a put credit spread, where I don’t need the stock to rally, but rather, it has to simply not go down by too much. Support is forming, the toolbox model indicates that over the next two weeks, MAR should be bullish, but at the very least, it shouldn’t go below $357 per share. I can express a higher probability trade by selling a February 27th $355/$352.50 put credit spread for about $0.82, which would be a nearly 50% return relative to the risk. That’s a very attractive return for a stock that should be bullish, but at the very least, seems better protected from the market downside risk than big tech names given its normal post-earnings pattern. And with all of the noise in this market, that’s a good trade setup for me.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments