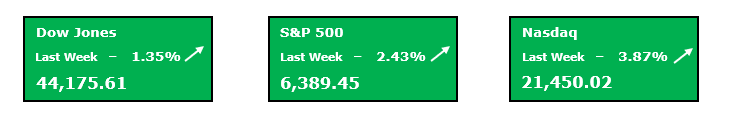

Last week served as solid evidence that investors still are very much of the “Buy the Dip” mentality. Headed into the week, the S&P had just experienced a sharp 4-day pullback, its largest since earlier this year in April. On Monday, investors decided that stocks had been punished enough on the back of the weak July Jobs report. As we said headed into last week, watching U.S. Treasury yields was going to be a key tell about how much the market was discounting economic weakness after the disappointing Jobs report. Yields rose slightly on the week, but it was hardly a sign of concern from the bond market. The absence of anxiety in the bond market was supportive for equity investors. So, the negative news from the prior week had been digested and investors turned their focus to the events of the week, namely earnings. As the major earnings reports of last week came in, most of the crucial ones delivered good numbers. When combined with the cumulative results for Q2, this seemingly helped to provide a sigh of relief for investors which added support for equity prices. In addition to the strong earnings helping to boost stock prices last week, the anticipation of a Fed rate cut coming in September got even stronger. Recent data has provided the dovish camp with more evidence that a cut is warranted, additionally, this camp is growing as more FOMC members have voiced that given recent data, adjustments to monetary policy now seem appropriate. To build even further, one FOMC voting member stepped down early, opening a slot on the voting committee, which will be filled by the President. The nominee, Miran, if confirmed, is sure to be amongst the most dovish on the voting committee, making addition rate cuts more likely. The combination of a calm bond market, strong earnings, and a Fed on the verge of reducing rates was exactly what was needed to buoy stock prices and send them trading higher toward all-time highs yet again.

At the index level, we had a strong recovery in stock prices following the previous week’s dip. As of Friday’s close, the S&P 500 was constructively climbing higher again, within 0.01% of the index’s all-time closing high. Despite this powerful rebound, there is a bit more occurring beneath the surface, so let’s dive in. While we had the headline S&P close essentially at its ATH, the same cannot be said for the Equal Weighted Index. Last week we experienced a significant outperformance by the headline S&P relative to the Equal Weighted Index. This is symptomatic of having narrow leadership in the S&P. While this is not necessarily negative for the fate of the Bull market, it is important to see the dispersion that is taking place in this market. It is clear that we are still seeing that A.I. is ‘driving the bus’. For those stocks and sectors that are highly connected to the A.I. narrative, they are still largely enjoying strong performance. However, for those that are not, they are mostly lagging behind. So as long as the A.I. story remains intact and these companies continue to deliver results, it’s arguable that this market can remain resilient even with narrow leadership, we’ve seen it in recent years several times. But it would be a welcome sign to see breadth improve in the back half of the year. I expect Tech to still lead but having the lagging sectors pick up some steam would provide more support for this market. Currently as it stands, only 58% of S&P 500 stocks are above their 200-day moving average, yet this number of stocks in a long-term uptrend is declining at present. Also, even as the S&P 500 has returned to its ATH’s, the key breadth indicator, the Advance/ Decline line has failed to do so, further evidencing what I have pointed out. Given this narrow leadership, I’m am still keeping my focus on those sectors and industries displaying powerful relative strength, namely Tech, a few in Comm Services, Utilities, Industrials, and pockets of the Financials too. Keeping this context in mind, the technicals for the S&P 500 itself look quite strong. Short, medium, and long term trends are all still intact and upside momentum appears to be reaccelerating. I still think it is possible that at the index level, stocks may experience a bit of rangebound trading in the weeks to come while some dueling narratives continue to play out.

✨ Unlock the power of precision trading with my WPO Newsletter—recent picks hit 52.4% & 117.4% peak gains in just weeks (past performance is not indicative of future results). Your first month is just $1—sign up now and seize your edge! 🏆

Key Events to Watch For

- Q2 Earnings Continue

- CPI/ PPI Inflation Reports – July

- U.S. Retail Sales – July

As we head into the middle part of August, the vast majority of Q2 earnings reports are now behind us. While the bar had been lowered headed into reporting season, companies have delivered solid numbers. After last week, 90% of S&P 500 companies have released their Q2 earnings reports with an impressive 81% of them posting upside EPS beats. Not only have we gotten a strong beat rate, but the earnings growth rate has also been impressive. There are a few notable companies remaining that have yet to report earnings and this coming week, we’ll hear from a few of them. On deck this week are Cisco Systems (CSCO), Applied Materials (AMAT), CoreWeave (CRWV), & Circle Internet Group (CRCL). Each of these reports is interesting for its own unique reason. For CRCL, a red-hot IPO from this year, this week’s earnings report will be their first as a public company and is certainly expected to draw heavy investor scrutiny given the stock performance since the IPO.

Two key inflation data points are due this week. Both the July CPI & PPI updated inflation reads will be revealed on Tuesday and Thursday respectively. Each of these reports is expected to show a gradual increase in YoY inflation which could be evidence that some price increases from tariffs are being to be passed through the system. Even though these are not the Fed’s preferred measure of inflation, investors will be watching these reports closely as markets are looking towards September hoping for the first of a series of rate cuts. There are signs that the labor market is slowing, but if inflation also begins to pick up at the same time, the Fed may find themselves in a tough spot in the last few months of the year.

The final event that we have circled on our calendar this week comes on Friday. To close the week, just before the market open, the July Retail Sales report is due. This is always a key report for traders to watch because despite all the noise about the economy, soft data surveys, and the U.S. consumer, this report is a true tell about what the U.S. consumer is actually doing. In an economy such as ours where more than 2/3rds of GDP is attributable to consumer spending, this report is a key hard data point about what is actually happening. Retails Sales are expected to have risen by 0.5% in July. Markets will be hoping for this number to be met or surpassed, indicating that consumption is remaining sturdy.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments