Looking at a broadly dropping market for profit opportunities almost always leads to put options. Puts can often get a bad wrap as excessively risky strategies, but not all put option contracts are the same. In a market like we are seeing now, buying puts can be lucrative.

Using bear market strategies when the market is dropping puts the wind at your back and can increase the likelihood of success. To completely discard puts is like throwing the baby out with the bathwater. The majority of the risk that is associated with puts is related to selling puts. This is because it creates an obligation to sell an underlying asset at a determined price. Buying puts, however, provides the right to sell an underlying asset at a determined price but NOT the obligation. There is a great example of a stock that is begging to offer great put opportunities right now. Tesla is in a freefall and really sets up potential put buying opportunities. Take a look:

Multiple reasons line up to indicate Tesla will continue to drop. It’s recent trend downward is very much intact and hasn’t provided any indication of reversing yet. It is below all major moving averages and the MACD isn’t showing any sign of moving upward. These are just two technical indicators that can offer insight into what to expect a stock to do in the future, but they are pretty reliable. There is a long list of indicators that can be used to further confirm the trend is intact.

In addition, there has been a direct correlation to Elon Musk’s Twitter deal and Tesla’s price. There is fear among investors that it will distract him from running the EV giant and jeopardize its success.

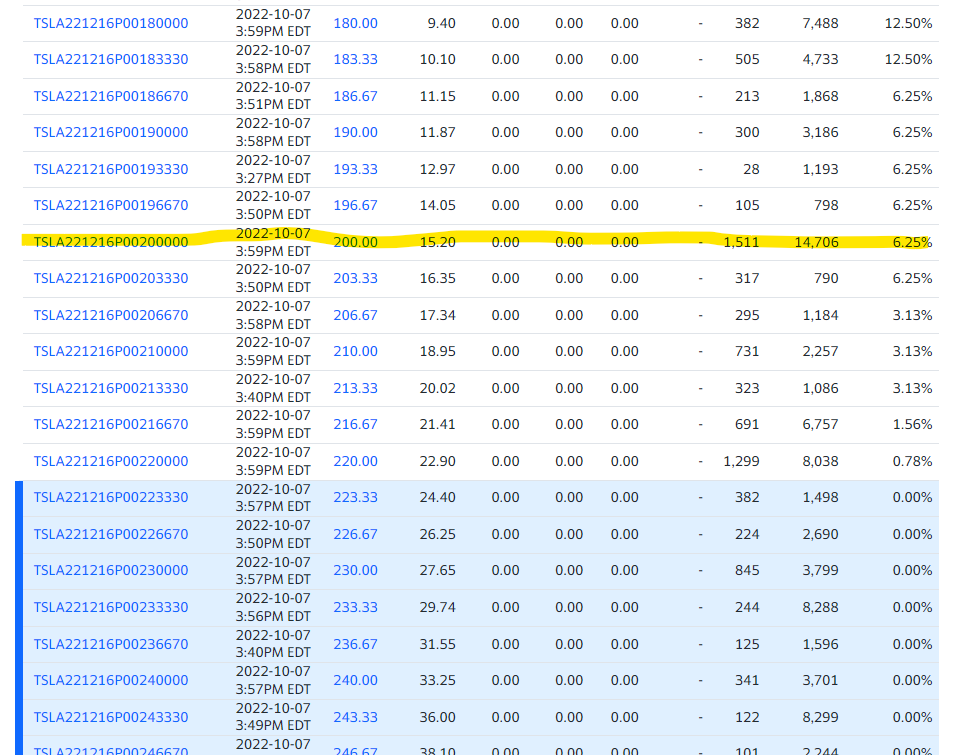

So when we look at the chart the recent double bottom low got down to around 200. That is a realistic target for this current drop to reach for. If we look at buying put options that will allow us to sell around that target, we can see Dec puts are selling at about $15.20.

That means if we buy those puts at $15.20 we have the right to sell TSLA at $200. If TSLA drops to $195, we can make $5 per share. The key here is the momentum at which TSLA drops. If it keeps dropping at this rate or drops quicker, the value of those Dec puts could go up very rapidly. The key here is that we know our risk is set at $15.20 per share. Since we have no obligation to sell the stock, our exposure is just the cost of the put option. If TSLA reverses unexpectedly and spikes to $250, we aren’t out $50 a share, just $15.20. Being able to lock in a risk that is acceptable to us BEFORE we place the trade is key.

On the flipside, if TSLA plummets to $150, we are in a nicely profitable position and have the potential to double our money. We can also look at other strike prices (possibly lower than the example of $195) that would have a lower premium. As the strike price get farther from the current price, the profit likelihood is lower but so is the premium. There is always risk when trading so be sure to do your homework and make sure the approach you use fits your risk profile.

Setting up the right option strategy doesn’t have to be complex. Don Fishback has laid out a great guide to how to do this that makes the trades with the highest profit potential very obvious. It is a quick read and super easy to understand. You can check it out here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments