Just two weeks ago, we highlighted opportunity in Viking Therapeutics (VKTX).

At the time, it traded at about $27.61 as it initiated its VANQUISH Phase 3 clinical program for VK2735, the company’s dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors. All as the company progresses with both oral and subcutaneous formulations for the potential treatment.

Today, the VKTX stock is up to $31.80 and is still a strong buy.

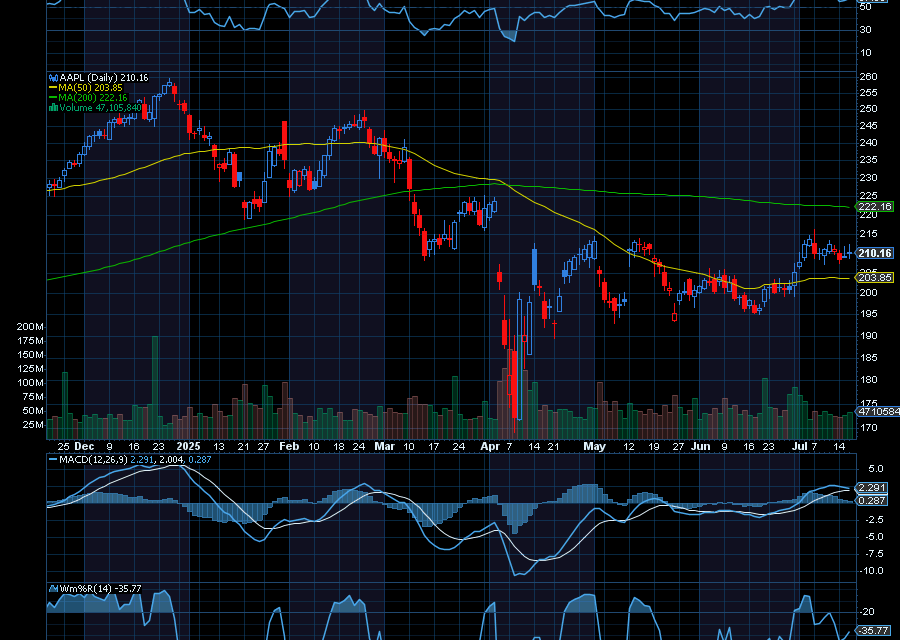

As for new trade ideas, Apple (AAPL) looks interesting. Last trading at $210.40, we’d like to see the tech giant break above triple top resistance with a near-term bearish gap refill at around $220. Helping, analysts at Jefferies just raised their price target on Apple to $188.32 from $170.62. The firm is still positive about the strength of Apple’s sales in the June 2025 quarter.

To potentially profit from further upside in Apple, investors can always buy the stock, call options, and even ETFs that pay weekly dividends.

Look at the AAPL WeeklyPay ETF (SYM: AAPW), for example.

With an expense ratio of 0.99%, the ETF pays weekly distributions that correspond to 120% the calendar week total return of Apple. All by investing in total return swap agreements and Apple stock. Plus, it just paid a dividend of just over 75 cents per share on July 15 to shareholders of record as of July 14. Before that, it paid a dividend of just over 22 cents on July 8.

Sincerely,

Ian Cooper

Recent Comments