Real estate investment trusts (REITs) allow you to earn passive income from a managed portfolio of income-producing real estate without ever having to own real estate.

“Because of the strong dividend income REITs provide, they are an important investment both for retirement savers and for retirees who require a continuing income stream to meet their living expenses. REITs dividends are substantial because they are required to distribute at least 90% of their taxable income to their shareholders annually. Their dividends are fueled by the stable stream of contractual rents paid by the tenants of their properties,” says REIT.com.

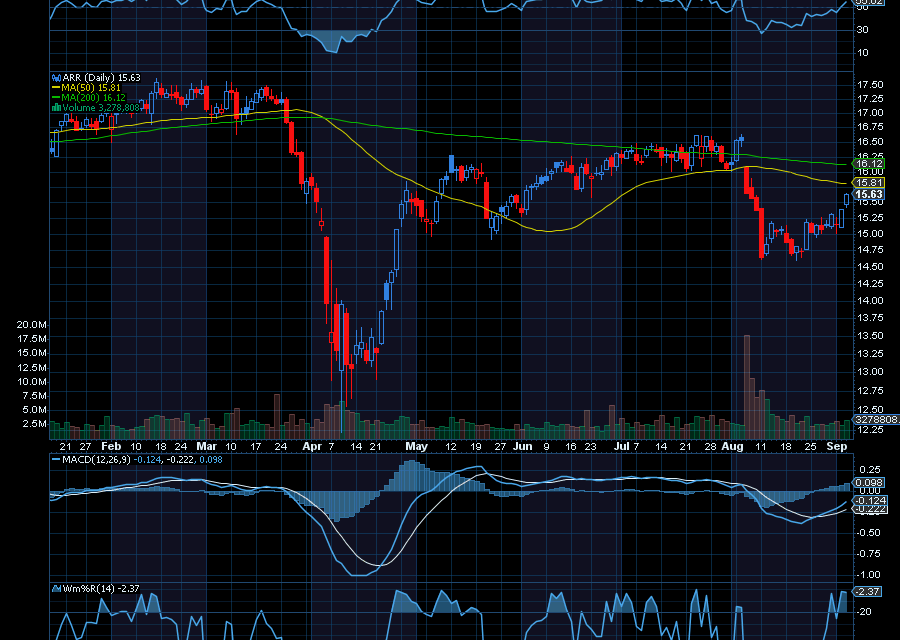

That being said, take a look at ARMOUR Residential REIT (SYM: ARR).

With a yield of 18.71%, REIT invests primarily in fixed rate residential, adjustable rate and hybrid adjustable rate residential mortgage-backed securities issued or guaranteed by U.S. government-sponsored enterprises or guaranteed by the Government National Mortgage Association. The REIT just declared a monthly dividend of 24 cents per share, which is payable on September 29 to shareholders of record as of September 15.

Technically, the ARR REIT is starting to pivot higher after catching support at $14.64. From here, we’d like to see it initially retest $16.50.

While we wait for the pivot higher, we can at least collect its yield.

Sincerely,

Ian Cooper

Recent Comments