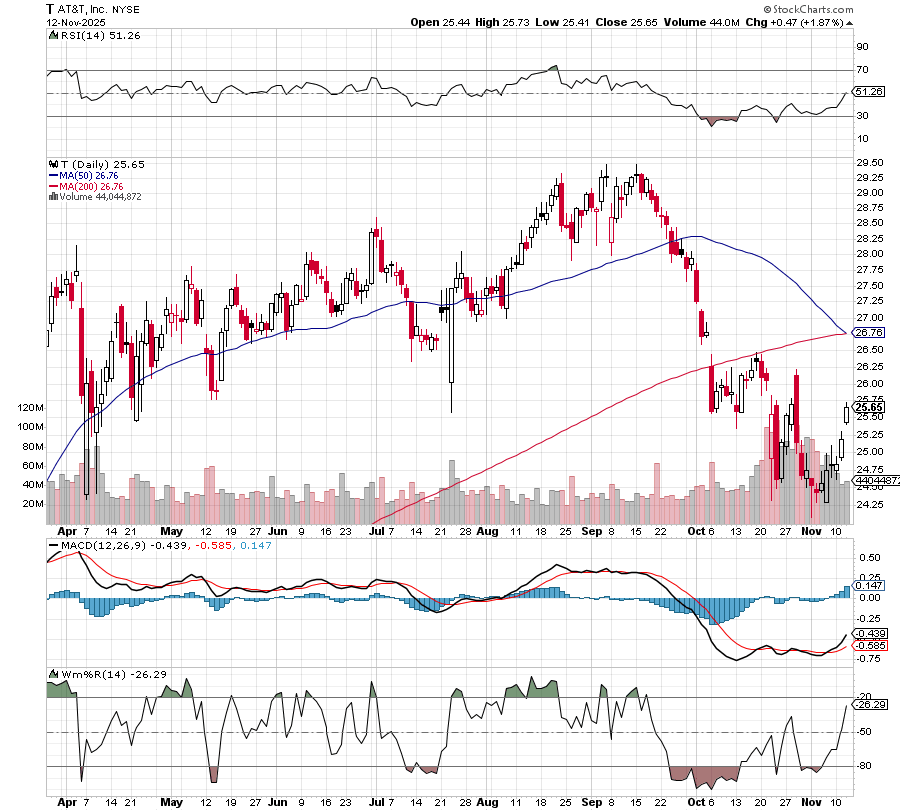

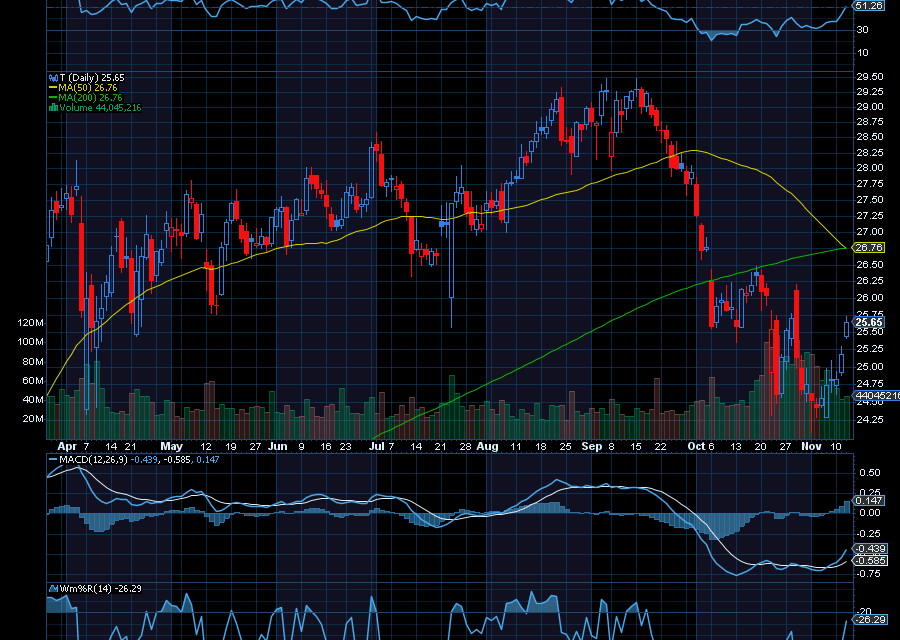

AT&T has become an oversold opportunity.

Over the last few weeks, the telecom giant took a hit on “overblown” concerns about the battle for mobile phone subscribers. However, the company did manage to cool some of those worries after reporting better than expected subscriber additions

In addition, analysts at KeyBanc Capital Markets just upgraded AT&T to an overweight rating with a price target of $30. The firm said the telecom giant looks even more attractive after the drop, especially with the stock’s solid capital return.

“We think the recent pullback was driven by competitive-related concerns in Wireless and are overblown,” said the firm as quoted by CNBC. “We argue that with AT&T’s strategic positioning, growth outlook, and capital return, a historical average multiple is warranted.”

“AT&T’s plan to reach 60M Fiber homes and business with Fiber, and its recent acquisition of 3.45GHz spectrum from Echostar, should position AT&T as the leader in convergence,” Nispel said. “Ultimately, we think AT&T has ~6.2M converged by the end of 2025, which we think should nearly double to ~12M by 2030,” they added.

Sincerely,

Ian Cooper

Recent Comments