Bitcoin didn’t have a great year.

After surging to record highs, Bitcoin is now below $88,000 with some traders warning it could drop to less than $40,000. Bloomberg Intelligence strategist Mike McGlone says it could drop to $10,000 in the new year on “post-inflation deflation,” a period when asset prices crash after an inflationary cycle, as noted by DL News.

If you’re also bearish on Bitcoin, you can always short crypto names, such as Strategy (MSTR) and MARA Holdings (MARA). But you can also bet on Bitcoin downside with:

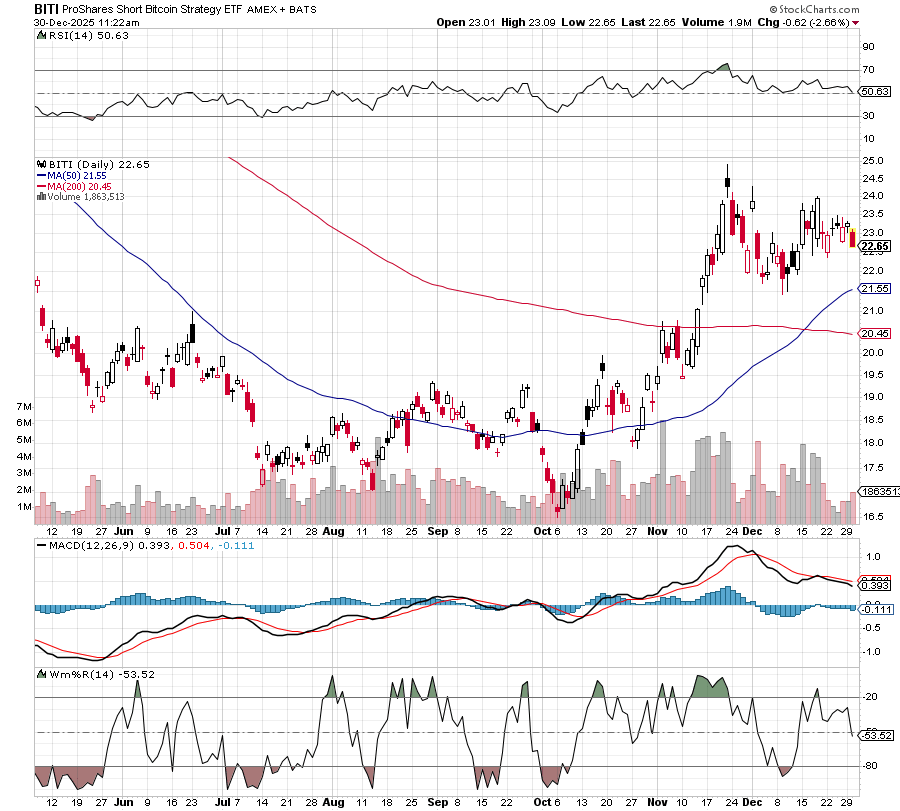

ProShares Short Bitcoin (BITI)

There’s the ProShares Short Bitcoin (BITI), which tracks the S&P CME Bitcoin Futures Index, with profitability computed daily (before fees and expenses) as the inverse (-1x) of the index’s daily performance.

ProShares UltraShort Bitcoin ETF (SBIT)

We can also look at the ProShares UltraShort Bitcoin ETF (SBIT). With an expense ratio of 0.95% and monthly dividends, the ETF seeks daily investment results that correspond, before fees and expenses, to -2x the daily performance of the Bloomberg Bitcoin Index.

Sincerely,

Ian Cooper

Recent Comments