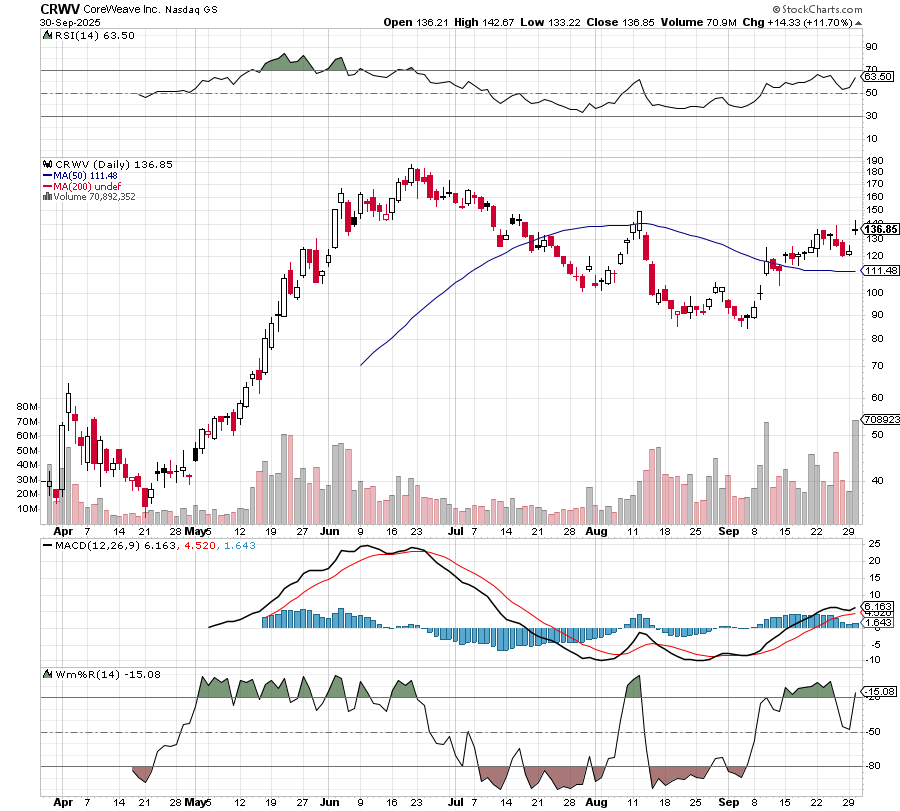

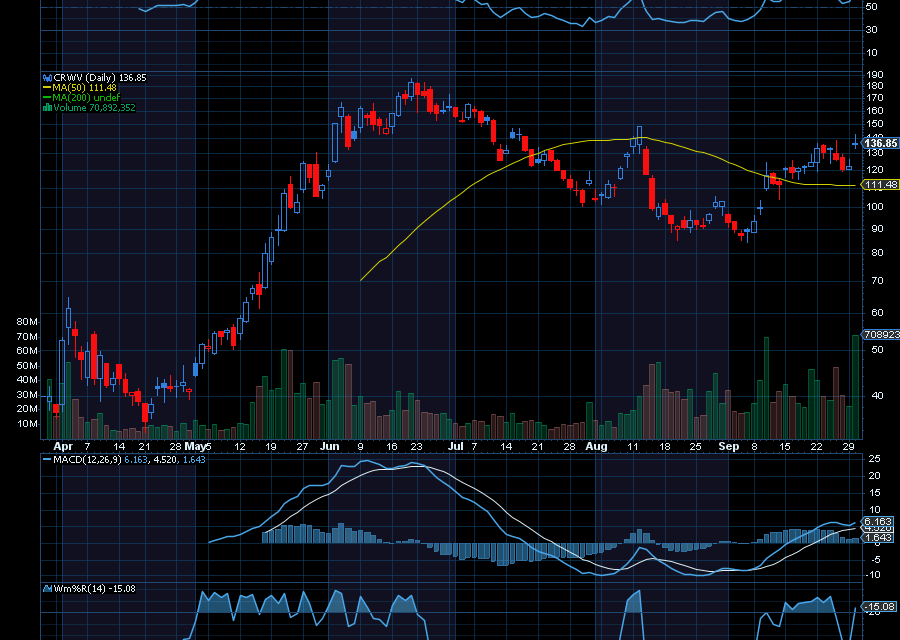

Shares of CoreWeave are still exploding higher.

For one, the company just signed a $14 billion AI infrastructure deal with Meta Platforms. This now guarantees CRWV will provide Meta with access to cloud computing capacity.

Two, just days ago, CRWV expanded its agreement with OpenAI by $6.5 billion, now bringing that contract value to $22.4 billion. Under the terms of that deal, CoreWeave will provide data centers and technology to OpenAI over five years.

Three, analysts love the stock.

In fact, thanks to the latest deal with Meta, analysts at Evercore ISI just initiated coverage of the stock with an outperform rating and a $175 price target.

As noted by Seeking Alpha, “According to the investment firm, demand for AI infrastructure far outpaces supply, and that will place an upside bias to revenues for CoreWeave. The analysts added that, meanwhile, a lower interest rate environment will diminish the cost to build the infrastructure for the company.”

Wells Fargo analysts also upgraded the stock to an overweight rating with a price target of $170, noting that “demand signals are growing too strong to ignore.”

“While the rest of software is stuck waiting for AI monetization to surface, CRWV stands to benefit from the elevated build cycle today & persistent industry shortages into 2026,” said the firm, as also quoted by Seeking Alpha.

In addition, analysts at Deutsche Bank say they see upward revisions coming for CRWV.

The firm, which has a buy rating on CRWV, says the company should benefit from the capacity expected to come online over the next year to 18 months. They also believe CRWV’s strong relationships with OpenAI, Microsoft, Meta, and Nvidia, should help send the stock higher.

Sincerely,

Ian Cooper

Recent Comments