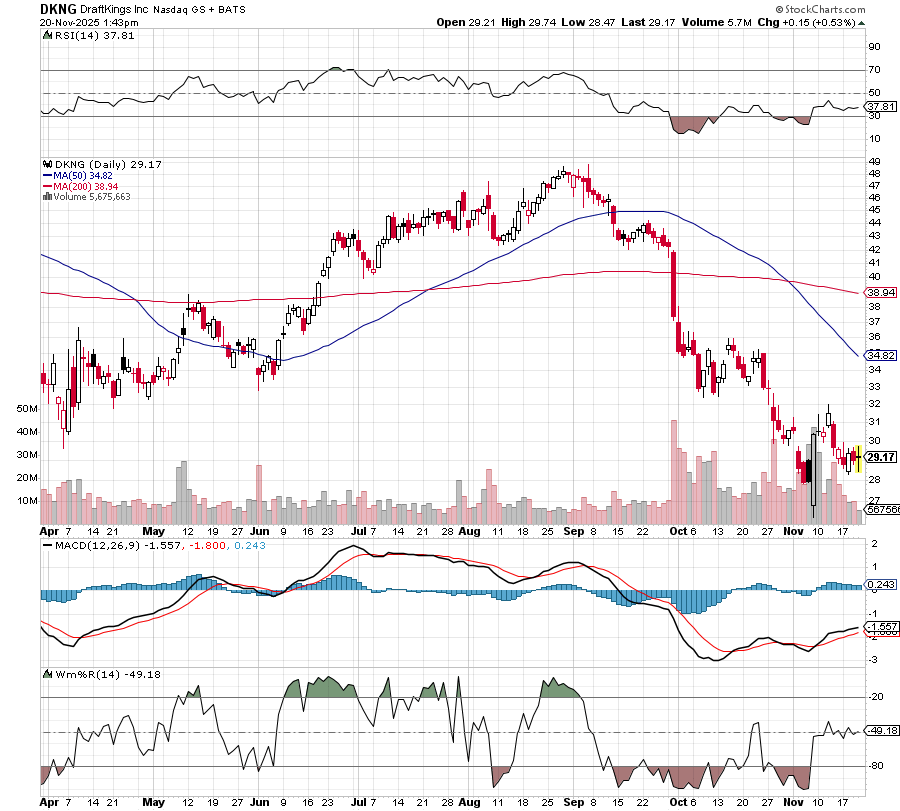

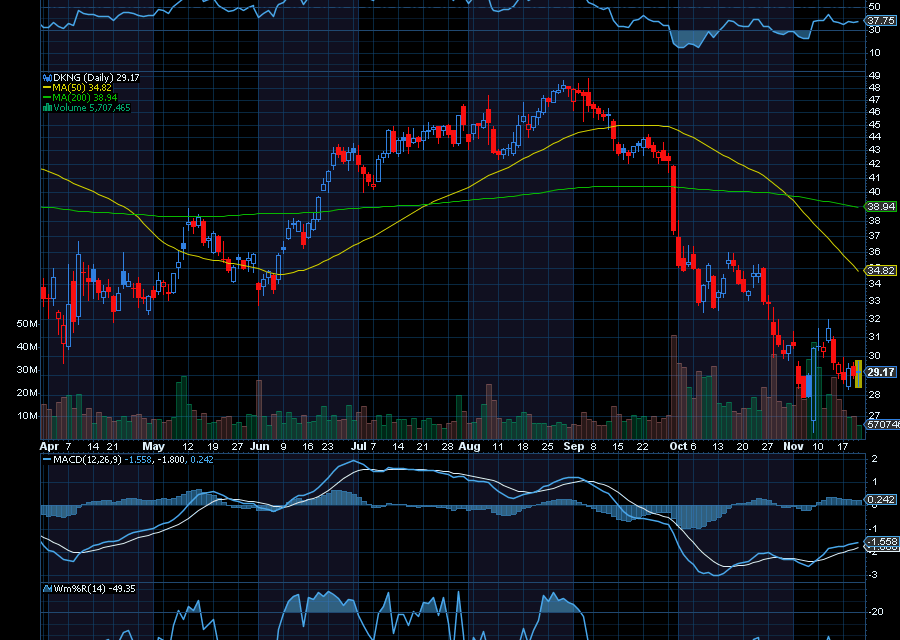

Over the last few weeks, gambling stock, like DraftKings (DKNG) plummeted.

For one, DKNG has seen recent selling pressure with underwhelming earnings.

In its third quarter, DKNG’s revenue of $1.14 billion fell short of estimates of $1.2 billion. Its EPS loss of 52 cents was worse than estimates of a 43-cent per share loss. Guidance of $5.9 billion to $6.1 billion in sales was below estimates of $6.19 billion.

Two, gambling stocks have been under pressure following disruptions from prediction market companies, such as Kalshi and Polymarket, which reportedly offer far more competitive gambling odds and lower trading fees.

As noted by Walkner Condon, “Because there’s no house acting as counterparty, Kalshi and Polymarket don’t charge a traditional rake on the spread. Their revenue comes from small trading fees (e.g., 0.5-2% per trade or settlement), which are typically much lower than the 4.5-10% implied rake at the typical sportsbook.”

As a result of the increased competition, DKNG resigned by the American Gaming Association over a disagreement about how the gaming industry should approach prediction market companies, like Kalshi and Polymarket.

However, it now appears the negativity has been priced into the DKNG stock.

At its current price of $28.72, DKNG is an oversold bargain. Plus, DKNG insiders have been buying the stock. Former Metro-Goldwyn-Mayer CEO Harry Sloan bought 25,000 shares of DKNG at $30.30 each, for a total of $757,500. New board member Gregory Wendt bought 10,000 shares for $30.27 each, for a total of $302,700.

In addition, analysts at Needham just reiterated a buy rating on DKNG with a price target of $52. The firm cited DKNG’s core online sports betting and iGaming products, which have contributed to DKNG’S 18.5% revenue growth over the last year.

Sincerely,

Ian Cooper

Recent Comments