At record highs, gold could soon test $5,000.

All as escalating tensions in Iran, mounting political pressure on the U.S. Federal Reserve, economic issues, and aggressive buying by global central banks boost demand.

According to analysts at HSBC, rising geopolitical risks could push gold above $5,050 during the first half of the year. “We believe that gold will continue to benefit from strong central bank demand, ongoing concerns over a weaker US dollar, and sustained interest in gold-backed ETFs,” HSBC said, as quoted by Mining.com.

Analysts at UBS say gold could rally to $5,000 by the third quarter, with the potential for $5,400 if political and economic risks mount. Bank of America is calling for $5,000 gold. JPMorgan is calling for $5,000 gold by the end of 2026.

Plus, demand from investors and central banks remains near record highs.

For example, according to the World Gold Council, as gold prices shattered records about 53 times in 2025, annual inflows into physically backed gold ETFs rocketed to $89 billion, “the largest on record as the gold price delivered its strongest performance since 1979. In turn, global gold ETFs’ assets under management (AUM) doubled to an all-time high of US$559 billion, with holdings reaching a historic peak of 4,025t, up from 3,224t in 2024.”

We should also note that in the third quarter of 2025, global central banks pushed their net purchases to 220 tonnes, a 10% year over jump, and a 28% jump quarter over quarter, with no clear signs of slowing demand.

Investors can always buy gold stocks like Barrick Mining and Newmont.

But if you want to safely diversify and pay less for the opportunity, invest in ETFs such as:

VanEck Vectors Gold Miners ETF

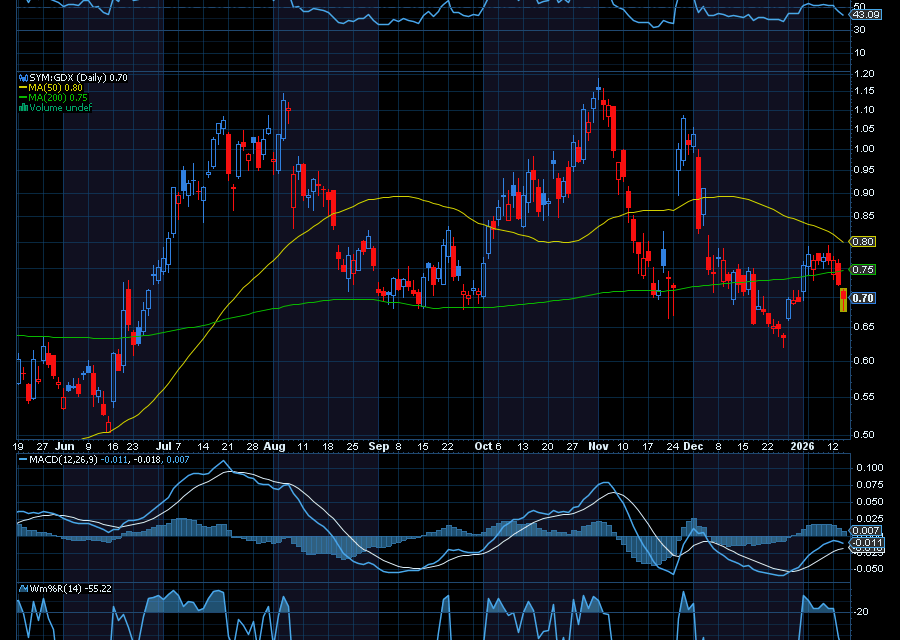

One of the best ways to diversify at less cost is with an ETF, such as the VanEck Vectors Gold Miners ETF (SYM: GDX). Not only can you gain access to some of the biggest gold stocks in the world, you can do so at less cost.

With an expense ratio of 0.51%, the ETF holds positions in Newmont Corp., Barrick Gold, Franco-Nevada, Agnico Eagle Mines, Gold Fields, and Wheaton Precious Metals to name a few.

The ETF also pays an annual dividend. In December 2024, it paid a dividend of just over 40 cents per share. In December 2023, it paid a dividend of just over 50 cents per share.

Even better, shares of mining stocks often outperform the price of gold. That’s because higher gold prices can result in increased profit margins and free cash flow for gold miners. In addition, top gold miners often have limited exposure to riskier mining projects.

Sincerely,

Ian Cooper

Recent Comments