Bitcoin has stumbled out of the gate this year, retreating sharply after its run to record highs.

The cryptocurrency is trading below $77,610, and some market participants warn the selloff may not be over. More bearish forecasts see Bitcoin falling below $60,000, with extreme downside scenarios pointing to levels near $30,000.

Several analysts cite weakening technicals and a fragile market. Crypto commentator Crypto Bitlord recently flagged $30,000 as a key long-term support level, arguing that the latest decline—triggered by a broader global market selloff—has further to run.

Investor Ted Pillows has pointed to historical patterns from the 2018 and 2022 downturns, noting that a comparable retracement would imply a decline of roughly 77%, potentially pushing Bitcoin toward $30,000 by 2026.

Plus, profit-taking has coincided with thinning liquidity and a lack of incremental buyers, according to CoinDesk. Traders told the site that demand once fueled by corporate accumulation—particularly Strategy’s Bitcoin purchases—has faded, leaving prices more vulnerable to forced selling and derivatives-driven liquidations.

Bitcoin’s decline has been strengthened by stronger U.S. dollar following President Trump’s decision to tap Kevin Warsh to lead the Federal Reserve, a move that has reduced the appeal of Bitcoin as an alternative currency and inflation hedge.

If you’re also bearish on Bitcoin, you can always short crypto names, such as Strategy (MSTR), and MARA Holdings (MARA). But you can also bet on downside with:

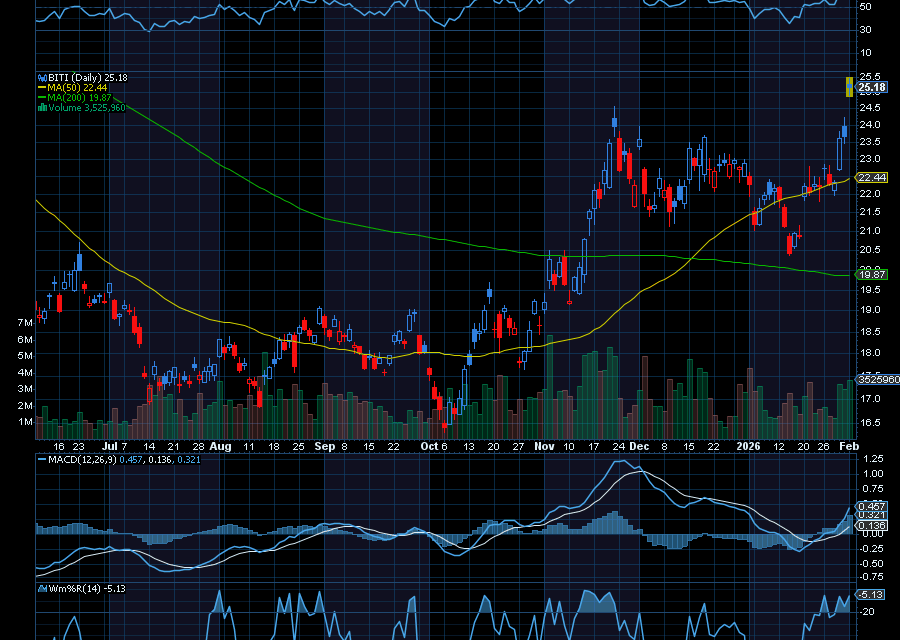

ProShares Short Bitcoin (BITI)

There’s the ProShares Short Bitcoin (BITI), which tracks the S&P CME Bitcoin Futures Index, with profitability computed daily (before fees and expenses) as the inverse (-1x) of the index’s daily performance. As Bitcoin has collapsed, the BITI ETF rallied from a recent low of $20.64 to a recent high of $24. Should Bitcoin break down even more, BITI could rally to $29.

The last time Bitcoin collapsed from about $125,000 in October to a low of $80,000, BITI ran from about $16.51 to a high of $25.

ProShares UltraShort Bitcoin ETF (SBIT)

We can also look at the ProShares UltraShort Bitcoin ETF (SBIT). With an expense ratio of 0.95% and monthly dividends, the ETF seeks daily investment results that correspond, before fees and expenses, to -2x the daily performance of the Bloomberg Bitcoin Index.

Sincerely,

Ian Cooper

Recent Comments