Bitcoin is still getting crushed.

In fact, it’s now at $67,750 and could see $60,000 before long, which would be great news for the inverse Bitcoin ETFs we mentioned on February 3. Those included:

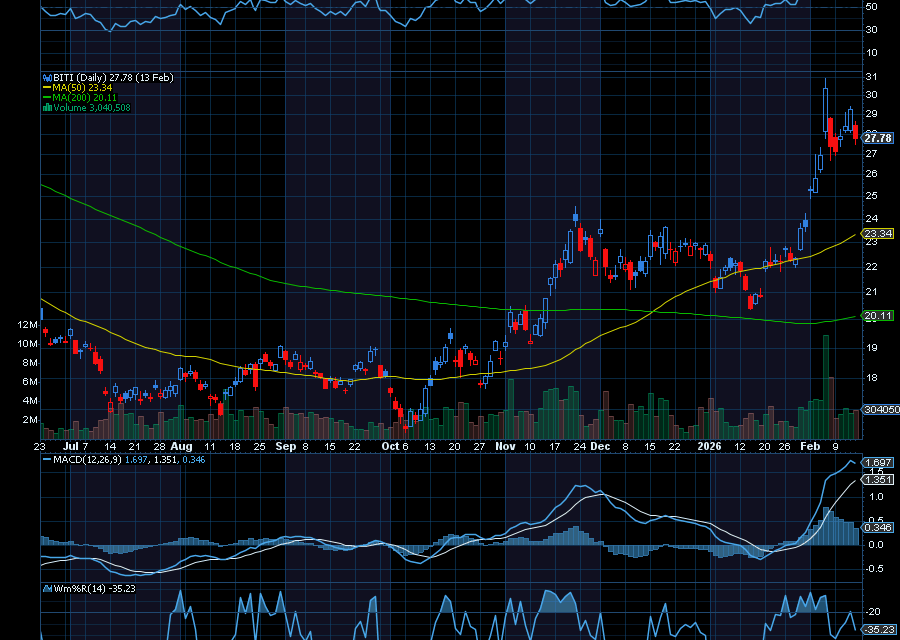

ProShares Short Bitcoin (BITI)

There’s the ProShares Short Bitcoin (BITI), which tracks the S&P CME Bitcoin Futures Index, with profitability computed daily (before fees and expenses) as the inverse (-1x) of the index’s daily performance. Since February 2, the BITI ETF has run from about $25.50 to a high of $31. Now back to $27.70, it could retest its prior high on Bitcoin weakness.

ProShares UltraShort Bitcoin ETF (SBIT)

We can also look at the ProShares UltraShort Bitcoin ETF (SBIT). With an expense ratio of 0.95% and monthly dividends, the ETF seeks daily investment results that correspond, before fees and expenses, to -2x the daily performance of the Bloomberg Bitcoin Index. Since February 2, the SBIT ETF has run from about $51 to a high of $76.52. Now back to $60.86, we do expect it to explode higher again as Bitcoin continues to drop.

Sincerely,

Ian Cooper

P.S. I have been tracking a way to exploit the rising volatility we are seeing and it has been working better than I expected. If you want to see how I am doing it, join me on Wed. Feb 18 at noon EST.

Recent Comments