With global tensions mounting, defense stocks are expected to surge even higher.

Earlier this week, defense stocks pulled back after President Trump said he would not allow dividends or buybacks for defense companies until arms production speeds up.

“Defense Companies are not producing our Great Military Equipment rapidly enough and, once produced, not maintaining it properly or quickly,” said President Trump, as quoted by CNBC. Until those companies build new production plants, “no Executive should be allowed to make in excess of $5 Million Dollars,” Trump added.

However, they’re benefiting from Trump’s calls for a $1.5 trillion defense budget.

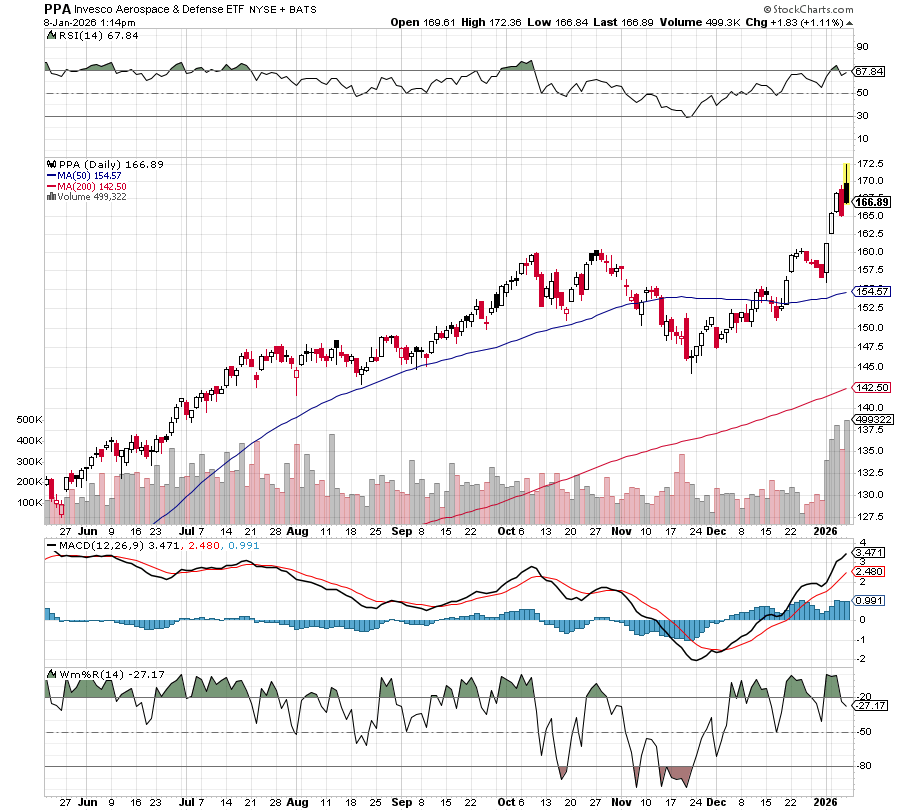

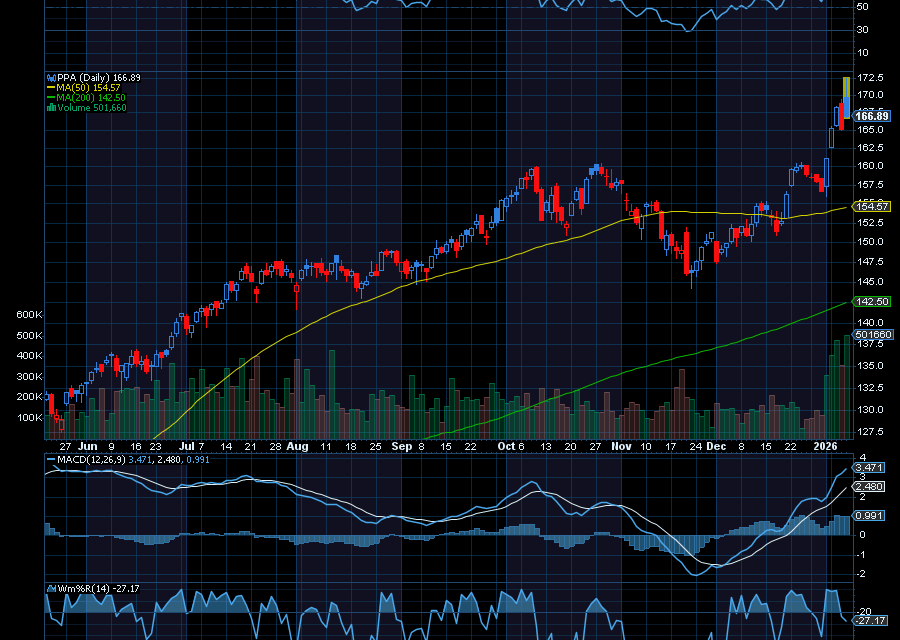

As he said on Truth Social: “After the long and difficult negotiations with Senators, Congressmen, Secretaries, and other Political Representatives, I have determined that, for the Good of our Country, especially in these very troubled and dangerous times, our Military Budget for the year 2027 should not be $1 Trillion Dollars, rather $1.5 Trillion Dollars. This will allow us to build the ‘Dream Military’ that we have long been entitled to, and, more importantly, that will keep us SAFE and SECURE, regardless of foe.”One way to gain significant exposure to multiple defense stocks at a lower cost is to consider an ETF such as the Invesco Aerospace & Defense ETF (PAA).

Sincerely,

Ian Cooper

Recent Comments