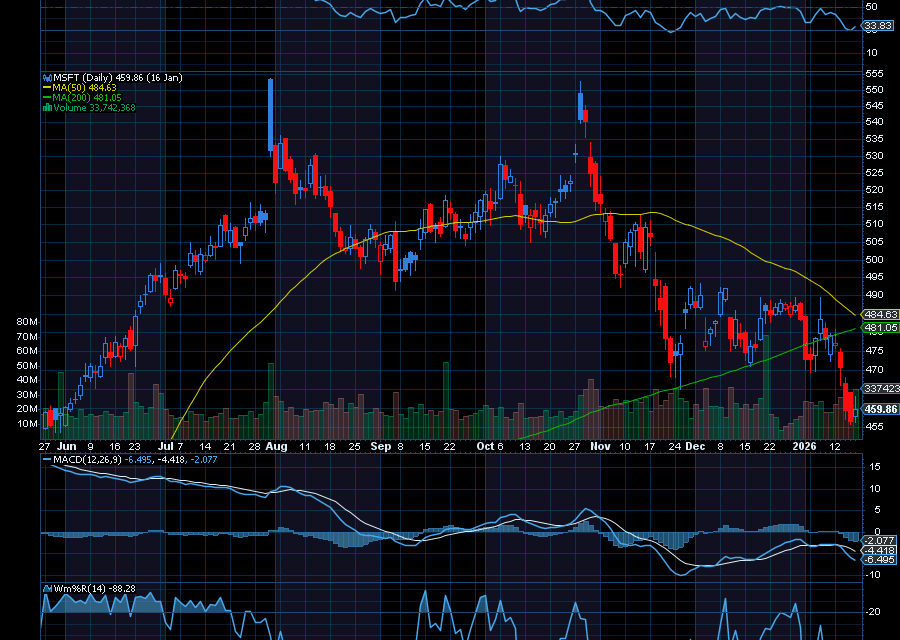

Microsoft has become ridiculously oversold at $459.96.

It’s also oversold on RSI, MACD, Williams’ %R, and on Full Stochastics. The last time these indicators were this oversold, MSFT bounced from about $468 to a high of $493.50. We’re looking for a similar bounce again now.

Helping, analysts at Goldman Sachs has a buy rating on MSFT with a $655 price target on MSFT ahead of its earnings on January 28. Morgan Stanley has an overweight rating with a $650 price target. Barclays has a $610 price target. JPMorgan has a buy rating with a $575 price target. And Wedbush has an outperform rating and a $625 price target.

Also, according to Wedbush analyst Dan Ives, “We view MSFT as the clear front-runner on the enterprise hyper-scale AI front,” as quoted by Barron’s. “In a nutshell we believe Microsoft is set to have a massive 2026 and the stock is a compelling buy at these levels.”

“Wall Street is still underestimating Microsoft’s AI growth potential, setting up the company to prove its doubters wrong next year,” they added.

Sincerely,

Ian Cooper

Recent Comments