With market volatility wreaking havoc on your portfolio, you can always protect it with high-yielding stocks.

After all, you’re just not going to make the money you want in today’s low-yielding savings accounts. You’re lucky if you earn 0.40% these days. So, if it’s dependable income you’re after, one of the best things you can do is invest in yielding stocks.

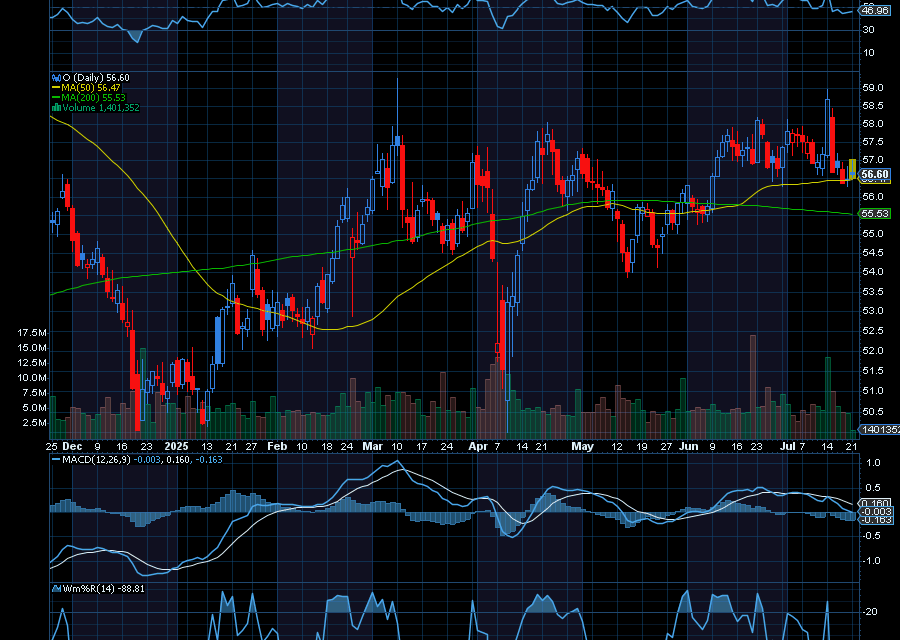

One of the top high-yielders to consider is Realty Income (O).

Realty Income, or The Monthly Dividend Company, pays a monthly dividend.

At the moment, with a yield of 5.72%, it just paid $0.2690 per share on July 25 to shareholders of record as of July 1. Annualized, that’s $3.228 per share. This is now the company’s 131st monthly dividend increase.

If you were to invest $10,000 in Realty Income, you’d take ownership of about 176 shares. Using its annualized dividend of $3.228, you could collect an easy $568.12 a year.

And all you have to do is hold the stock.

Making it even more attractive, Realty income is one of the biggest lease real estate investment trusts (REITs) you can buy. It also owns more than 15,600 properties, with a vast majority of that in the retail sector. In fact, some of its biggest tenants include 7-Eleven, Dollar General, Walgreen’s, Wynn Resorts, FedEx, BJ’s Wholesale Club, CVS, and Tractor Supply.

Sincerely,

Ian Cooper

Recent Comments