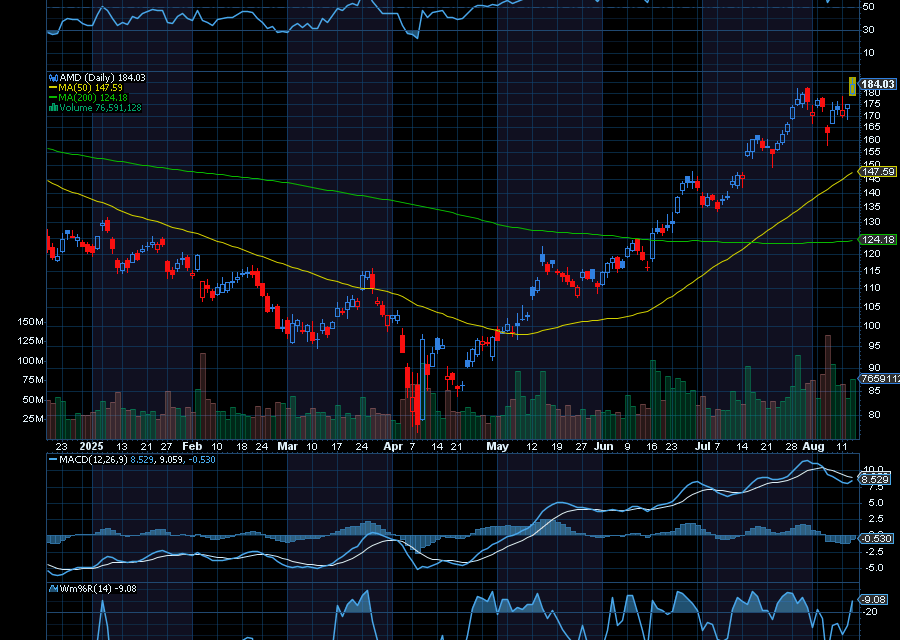

Just a few weeks ago, we said, “After a brief pullback, shares of Advanced Micro Devices (AMD) are just starting to pivot higher again. Last trading at $157.10, we’d like to see the stock test $175, near-term. Helping, AMD Executive Vice President and Chief Commercial Officer, Philip Guido bought 8,800 shares of the stock for just under $1 million.”

Now at $174.95, we’re now calling for $200.

Helping, analysts at Benchmark reiterated its Buy rating and raised its price target to $210 from $170 after strong earnings growth.

In its most recent quarter, AMD posted revenue of $7.685 billion, up 32% year-over-year and 3% quarter-over-quarter. It was also $270 million above Wall Street expectations of $7.415 billion. Moving forward, AMD expects revenue of $8.7 billion, up 13% quarter over quarter, and 28% year over year. That’s also above analyst expectations of $8.32 billion.

We also have to remember the company is exposed to a multi-billion-dollar addressable market for data center AI chips. In fact, according to company Chair and CEO Lisa Su, that addressable market for AI chips will reach $500 billion by 2028, which is up from her prior estimate for $400 billion by the time 2027 rolls around.

Plus, the company’s latest generation of AI chips, the MI300, is its fastest ramping product ever. Lisa Su added that AMD’s MI300X chip – which rivals dominant AI chipmaker Nvidia’s H100 is “the most advanced AI accelerator in the industry,” as noted by Time.com.

Sincerely,

Ian Cooper

Recent Comments