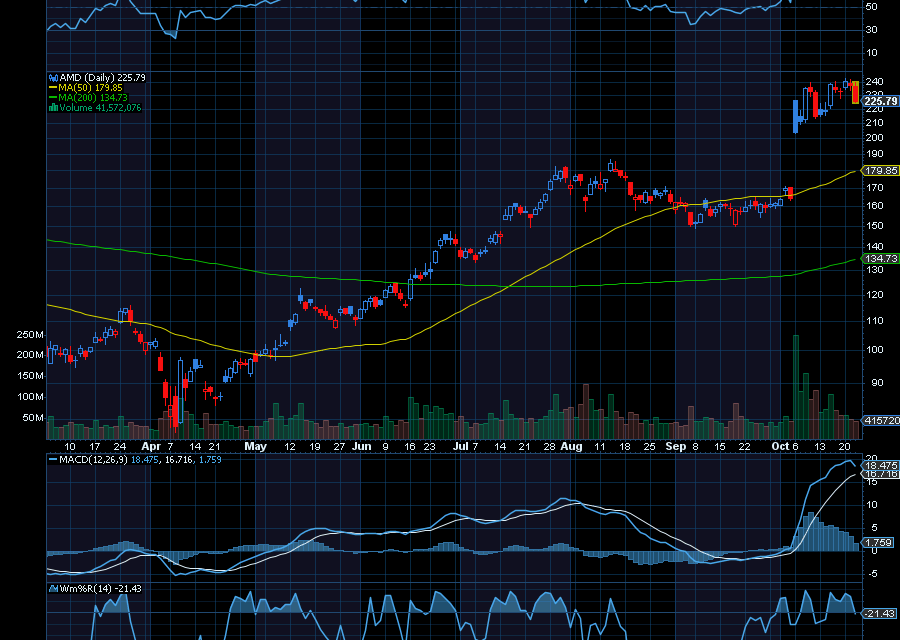

We’ve been pounding the table over Advanced Micro Devices (AMD) for some time.

We mentioned Advanced Micro Devices (AMD) in late August, as it traded at $167.76.

At the time, we noted, “We have another opportunity to jump on Advanced Micro Devices’ (AMD) weakness. After a brief pullback, AMD caught triple bottom support, and is just starting to pivot higher again. Last trading at $167.76, we’d like to see it initially retest $185 a share. Longer term, we’d like to see it test $200.”

Then, just two weeks ago, we highlighted it as an opportunity again at $210.80.

Today, AMD is up to $236.55 and could rally even higher.

Helping, AMD announced a long-term deal to become a key supplier to OpenAI’s AI infrastructure program. “OpenAI plans to deploy 6 gigawatts worth of AMD Instinct graphics processing units, or GPUs, over the course of the partnership. The first 1 gigawatt deployment will begin in the second half of 2026, the companies said. For context, one nuclear reactor can typically generate one gigawatt of electricity, as reported by Barron’s.

AMD added that the new partnership will allow it to generate billions of dollars in annual revenue. It will also allow it to generate over $100 billion in total revenue from chips over the next few years.

Even better, analysts at Barclays just raised their price target on AMD by $100 to $300.

“The price target increase follows AMD’s partnership deal with OpenAI, which Barclays describes as ‘designed to be mutually beneficial to OpenAI and AMD, and more pointedly drive the stock higher,’” added Investing.com.

Plus, according to analysts at Wedbush, the latest deal is a “major movement in AI revolution.”

Analysts at Piper Sandler also raised their price target on AMD to $240 with an overweight rating. “In exchange, OpenAI will receive 160M warrants for AMD stock as specific milestones are achieved over the next five years.”

Sincerely,

Ian Cooper

Recent Comments