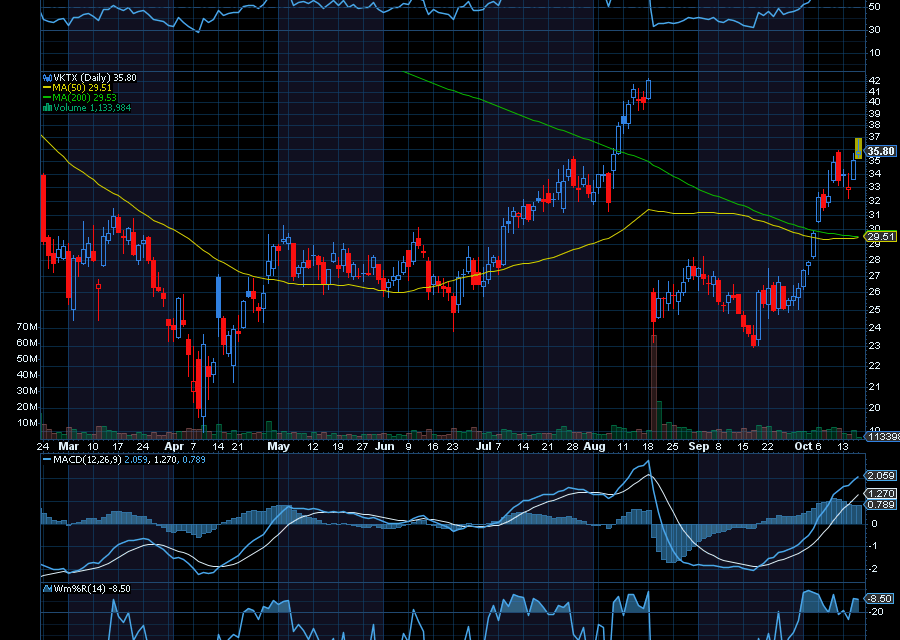

In late August, we highlighted opportunity in oversold shares of Viking Therapeutics (VKTX), as it traded at $26.62.

We noted, “Over the last few weeks, VKTX plummeted from about $40 to $26.05. All after the company posted mid-stage trial data on its obesity pill that fell short of expectations. However, analysts are still bullish on the stock. As Viking Therapeutics pointed out, 98% of the adverse effects in the trial were mild to moderate. About 99% of gastrointestinal (GI) related issues were mild to moderate. In short, the pullback in VKTX was a severe overreaction.”

Today, the stock is up to $36 and could rally even higher, near term.

All as the company gets closer to rivaling Eli Lilly’s GLP-1 treatment. At the moment, VKTX’S leading candidate, VK2735 is a dual GLP-1 and GIP medicine being developed in subcutaneous and oral formulations. Both are which are showing good results.

Most recently, as noted in a VKTX press release, “Viking announced positive top-line results from the Phase 2 VENTURE study of subcutaneous VK2735 in obesity. The VENTURE trial successfully achieved its primary and all secondary endpoints, with patients receiving VK2735 demonstrating clinically meaningful reductions in body weight compared with placebo. VK2735 also demonstrated encouraging safety and tolerability in the VENTURE study, with the majority of observed adverse events (AEs) being reported as mild or moderate.”

Sincerely,

Ian Cooper

Recent Comments