One of the best ways to build wealth is by investing in down, but not out stocks, which also carry hefty dividends. Not only can you make money as you wait for the stock to recover, but you can also benefit from high dividend returns along the way.

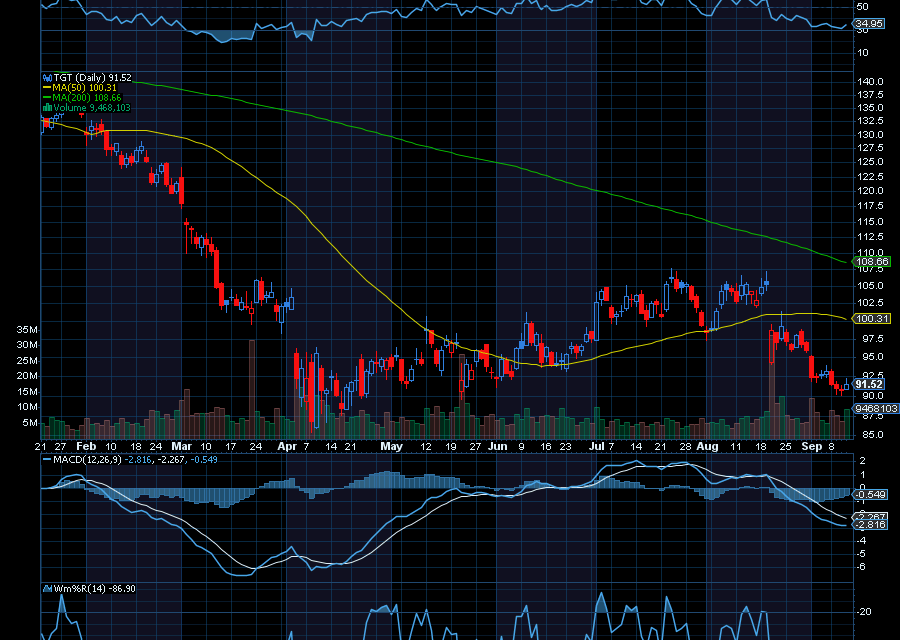

Look at Target (TGT), for example.

While it’s been in a steady downtrend thanks to economic uncertainty, supply chain issues, and a series of controversial political issues that resulted in fewer shoppers.

However, despite the pullback, the retailer continues to hike its dividends. With the streak now at 54 years, Target is a Dividend King, with a yield of 5%. The company’s next dividend of $1.14 per share was paid on September 1, marking its 232nd increase.

Additionally, we have to consider that Target’s current valuation factors in a great deal of negativity – especially as it traded at 10.5x earnings, as compared to Walmart’s 38.

Also, as noted by Seeking Alpha, “Despite ongoing margin and sales headwinds from tariffs and a cautious consumer environment, management is maintaining full-year guidance and targeting $15 billion in sales growth over the next five years.”

Sincerely,

Ian Cooper

Recent Comments