One of the most successful investors is Warren Buffett.

At the age of 94, he’s now worth about $148.2 billion.

Typically, when Buffett or Berkshire Hathaway buys a stock, it can lead to increased investor confidence and potentially higher stock prices due to the reputation of the firm, and the longstanding belief Buffett buys quality stocks at a quality price.

Most recently, he picked up shares of UnitedHealth Group (SYM: UNH), for example, which sent the stock up about 14% higher on the day.

If you don’t have much time, but still want exposure to the billionaire’s picks, you can always pick up Buffett-fueled exchange traded funds (ETFs), such as:

The Vanguard S&P 500 ETF (VOO)

“Over the years, I’ve often been asked for investment advice,” Buffett wrote in a 2016 shareholder letter. “My regular recommendation has been a low-cost S&P 500 index fund.”

With that, Buffett has named the Vanguard S&P 500 ETF (VOO) as one way to invest.

What makes it most attractive is that the ETF measures the performance of the S&P 500, and includes value stocks and growth stocks from multiple market sectors. In fact, it holds Nvidia, Microsoft, Apple, Amazon, Alphabet, and Berkshire to name a few.

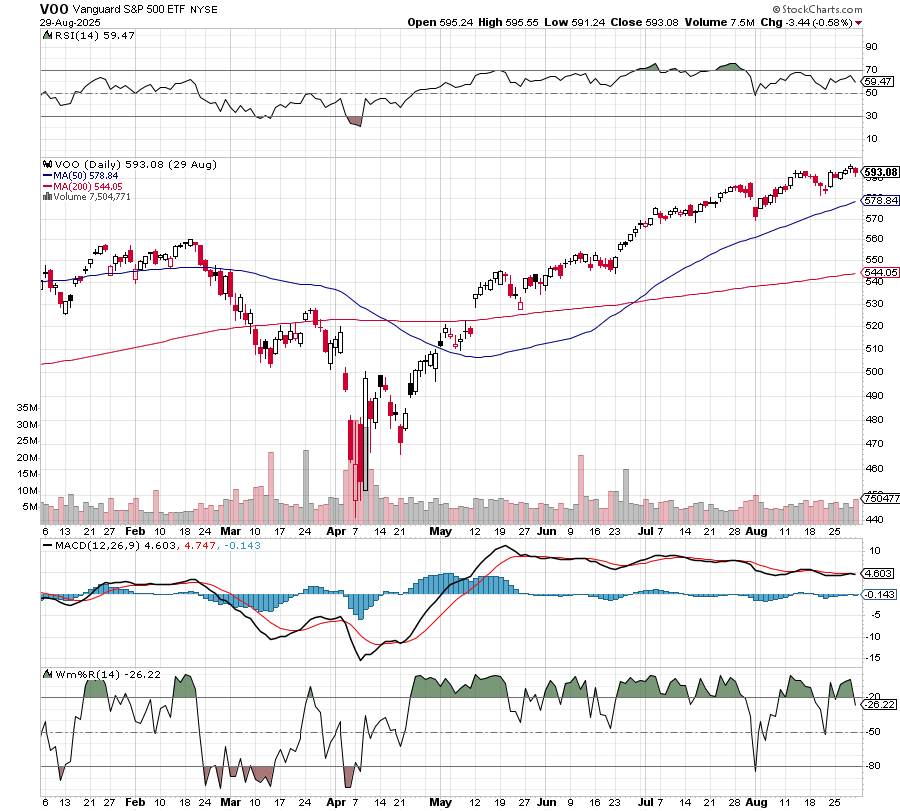

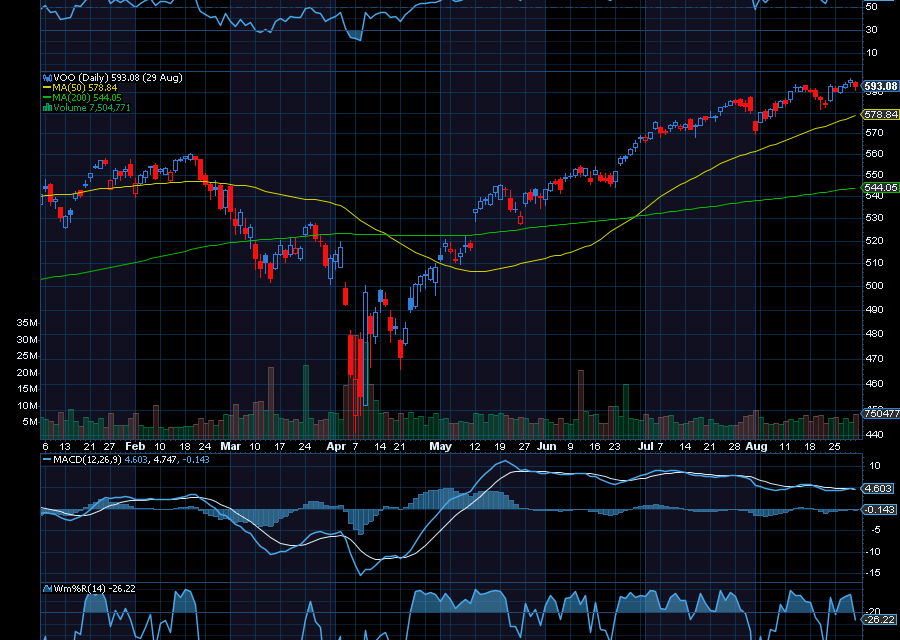

With an expense ratio of 0.03%, the ETF pays a quarterly yield. On July 2, it paid out a dividend of $1.744700. On March 31, it paid out $1.812100. Also, since VOO bottomed out at around $450 in April, it rocketed to $596.52. From here, we’d like to see it test $650.

Sincerely,

Ian Cooper

Recent Comments